Telangana Minority Loan Scheme:- The chairman of the Telangana Minorities Finance Corporation said that funding help would be made available. For those members of the minority class interested in expansion or starting a business. People who belong to minorities such as Sikhs, Jains, Muslims, and Christians may avail the benefits of the Telangana Minority Loan Scheme. All persons who meet the eligibility conditions including those aged 21 and above, may submit applications. People who are living in villages have an income that is a minimum of 1.5 lakhs for rural residents and, who have an income that is a minimum of 2000 Rs for people living in cities. The Official Website may be used by interested people to apply in person.

Overview of Telangana Minority Loan Scheme

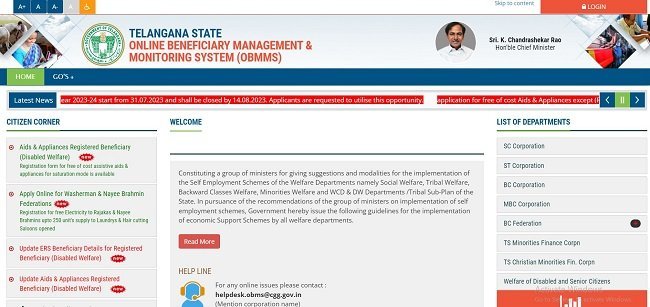

The Chief Minister of Telangana, Mr. K. Chandrashekhar Rao, started the Telangana Minority Loan Scheme. Under this scheme, the government provides two loan options to minorities who wish to start their own businesses. The first option is a loan of Rs. 1 lakh with an 80% subsidy, and the second option is a loan of Rs. 2 lakhs with a 70% subsidy. Over 1.5 lakh members of the minority community can avail themselves of this scheme. To apply for the loan, you can either fill out an online form or visit the Office or District Office. Only BPL families with white ration cards are eligible for the subsidy loans. The Online Beneficiary Management and Monitoring System encourages everyone to take advantage of this remarkable scheme.

Also Read: Startup Telangana

Objective of Telangana loan scheme

The objective of this program is to offer lower interest rates for minority communities in order to encourage them to set up their own businesses and create employment opportunities. In doing so, we will increase living standards among minorities and improve their economic situation. You’re going to get a discount on the credit that you take out through an institution established in Telangana state if you come from a minority community. For amounts up to 1 lakh rupees, there are two different loan schemes, both being members of minorities. For the former, an 80% subsidy is provided, while for the latter, a 70% subsidy. More than 1.5 lakh people now have access to these loans thanks to the government

Key Highlights of Telangana Minority Loan Scheme

| Scheme name | Telangana Minority Loan Scheme |

| Launched By | State Government of Telangana |

| Year | 2025 |

| Beneficiaries | Anyone who belongs to a minority |

| State | Telangana |

| Objective | Provides loans to the minority communities in Telangana |

| Application mode | Online |

Eligibility Criteria for the Telangana Minority Loan Scheme

- The applicant must reside in Telangana state permanently

- He or she should be a member of a minority group

- An Aadhaar card is required for applicants

- The applicant’s age must fall between 21 and 55 years old

- The candidate’s annual household income from all sources cannot be more than Rs.1.5 lakh in rural regions and Rs.2 lakh in urban areas

- Under the economic assistance scheme, subsidized loans are only available to BPL households that possess white ration cards.

Also Read: Telangana Chenetha Maggam Scheme

Benefits and Features of the Telangana Minority Loan Scheme

- The Telangana state government extends financial support to minorities through a specific program.

- This initiative offers monetary aid to TS Minority Individuals via the official website of the Online Beneficiary Management and Monitoring System.

- Within this framework, the government presents two distinct loan alternatives for minorities: one for sums up to 1 lakh rupees and another for amounts up to 2 lakh rupees.

- These lending schemes feature varying subsidies – 80% for the former and 70% for the latter.

- A notable statistic reveals that over 1.5 lakh individuals have availed themselves of government-sponsored loans.

- The subsidy loans are exclusively available to BPL families possessing white ration cards.

- The Online Beneficiary Management and Monitoring System (OBMMS) has encouraged all eligible individuals to make the most of this exceptional program

- This scheme primarily aims to offer discounted loans to the minority community, enabling them to initiate their own enterprises and generate job prospects, consequently enhancing the quality of life within the minority community.

Required Documents

- The candidate’s passport-sized photograph

- Aadhar card

- Proof of income

- Certificate of Minority status

- Residential certificate

- Contact number

- Bank statement Email address

Selection Process for Telangana Minority Loan Scheme

- The requirement is for applicants to hold permanent domicile in the state of Telangana.

- Individuals aged between 21 to 55 years are eligible to apply for the loans.

- The loans are exclusively available for members of the minority community.

- The applicant’s family should have an annual income of no more than 1.5 lakhs

Application Process for Telangana Minority Loan Scheme

- Please start by visiting the official website of the Telangana State Online Beneficiary Management and Monitoring System.

- Once the homepage loads, find and click on the “Apply Online for Economic Support Scheme (Minorities Finance Corporation 2022-2023)” link.

- This action will take you to a new page. On that page, locate and click on the “Economic Support Scheme Beneficiary Registration” link.

- This will bring up a registration form on your screen. Fill in all the necessary information, such as your name as per your Aadhaar Card, Aadhar Number, and Food Security Card number, and choose the appropriate Category, Type of Financial Assistance, Sector, and Scheme.

- To proceed, click on the “Go” button.

FAQ’s

The primary goal of the program involves the provision of financial aid to minorities by the Telangana state government. The government is offering loans to minority communities, including Muslims, Sikhs, Parsis, Buddhists, and Jains, to facilitate the establishment of their own businesses

The government provides two distinct loan schemes for minorities: one with an 80% subsidy and another with a 70% subsidy, for amounts ranging up to 1 lakh rupees and 2 lakh rupees respectively. Over 1.5 lakh individuals have the opportunity to avail loans from the government.

The government of Telangana has specifically launched this scheme for the minority people who are living in the state. Any person who belongs to a minority community be it Sikh, Muslim, or Jain. Christians, Parsi, etc. can apply for this scheme.

The application mode for this scheme is online. You have to visit the official site of the Telangana government for minorities and apply there. The link to the site is given above in the Application process.