The PM Vidyalaxmi Scheme, approved by the Union Cabinet, aims to ensure financial support for meritorious students admitted to top 860 higher education institutions across India, based on NIRF rankings. Students can access collateral-free, guarantor-free loans via a digital application process. Loans up to Rs. 7.5 lakhs will receive a 75% government credit guarantee. Additionally, students from families with annual income up to Rs. 8 lakhs will receive a 3% interest subvention on loans up to Rs. 10 lakhs, with full subvention for families earning up to Rs. 4.5 lakhs. With an outlay of Rs. 3,600 crore, this scheme targets 22 lakh students yearly and enhances existing schemes like PM-USP, promoting affordable access to quality higher education through a unified PM-Vidyalaxmi portal.

About PM Vidyalaxmi Scheme

The PM Vidyalaxmi Scheme, approved by the Union Cabinet, provides financial aid for meritorious students to pursue higher education without financial constraints. Targeting 860 top-ranked institutions as per NIRF rankings, the scheme enables students to access collateral-free and guarantor-free education loans through a fully digital application process. Loans up to Rs. 7.5 lakhs will have a 75% credit guarantee from the government, facilitating wider coverage by banks.

For students with annual family incomes up to Rs. 8 lakhs, a 3% interest subvention will apply on loans up to Rs. 10 lakhs, with full interest subvention for those from families earning up to Rs. 4.5 lakhs. An annual outlay of Rs. 3,600 crore will benefit over 22 lakh students each year, prioritizing those in technical and professional programs. The Vidyalaxmi Scheme operates through the PM-Vidyalaxmi portal, enhancing the reach of government educational initiatives like PM-USP to maximize affordable access to quality higher education across India.

What is NIRF?

The National Institutional Ranking Framework (NIRF) is a system developed by India’s Ministry of Education in 2015 to assess and rank higher education institutions. Its main purpose is to help students, parents, and educators understand the quality of colleges and universities across India. NIRF ranks institutions based on important factors like teaching quality, research work, graduation outcomes (such as job placements), inclusivity, and overall reputation. Each year, NIRF releases rankings across various categories, including engineering, management, medicine, pharmacy, and overall institutional quality. This ranking helps students and families make informed choices about where to pursue higher education. Institutions ranked by NIRF are seen as high-quality and trustworthy, making the framework a reliable source for evaluating educational institutions in India.

Summary of PM Vidyalaxmi Scheme College List

| Name of the Article | PM Vidyalaxmi Scheme College List 2024 |

| Name of the Scheme | PM Vidyalaxmi Scheme |

| Objective | To provide financial support to meritorious students for higher education through collateral-free, guarantor-free education loans |

| Target Institutions | Top 860 quality Higher Educational Institutions (QHEIs) across India |

| Selection Criteria for Colleges | Based on the latest National Institutional Ranking Framework (NIRF) rankings |

| Included Institutions | All HEIs (public and private) ranked within the top 100 in NIRF in overall, category-specific, and domain-specific rankingsState government HEIs ranked 101-200 in NIRFAll central government institutions |

| Annual Coverage | Over 22 lakh students annually from the top 860 higher education institutions |

| Loan Amount | Up to Rs. 10 lakhs, with special provisions, Loans up to Rs. 7.5 lakhs receive a 75% credit guarantee by the Government |

| Interest Subvention | 3% interest subvention for loans up to Rs. 10 lakhs for students with family income up to Rs. 8 lakhs.Full interest subvention for students with family income up to Rs. 4.5 lakhs. |

| Preferred Students | Students from government institutions and those enrolled in technical/professional courses |

| Funding Outlay | Rs. 3,600 crore from 2024-25 to 2030-31 |

| Implementation Period | 7 lakh new students are expected to benefit annually during the period |

| Administering Department | Department of Higher Education, Ministry of Education |

| Application Portal | PM Vidyalaxmi portal |

| Payment Method | Interest subvention paid via E-vouchers and Central Bank Digital Currency (CBDC) wallets |

| Official Website | https://www.vidyalakshmi.co.in/ |

Objective of PM Vidyalaxmi Scheme College List

The objectives of the PM Vidyalaxmi Scheme College List are as follows:

- The primary objective of the scheme is to support meritorious students financially so they can pursue higher education without barriers.

- The aim of the scheme is to provide easy access to education loans without needing collateral or a guarantor.

- The scheme aims to enable students admitted to top 860 colleges (based on NIRF rankings) to receive loans.

- The objective of the scheme is to expand access to quality higher education by covering tuition fees and related expenses.

- The scheme aims to promote inclusivity by prioritizing students from economically weaker families.

Also Read: PM Vidyalaxmi Scheme Apply Online

Selection of Colleges Under PM Vidyalaxmi

Selection of Colleges Under PM Vidyalaxmi follows as:

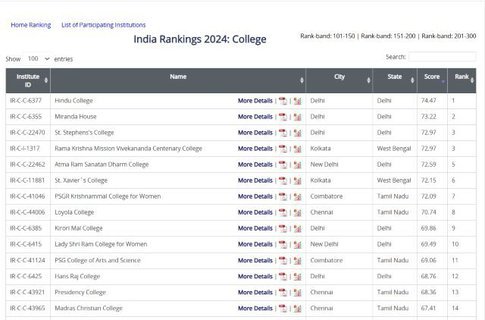

- Colleges are selected based on the latest National Institutional Ranking Framework (NIRF) rankings.

- Includes all HEIs (both public and private) ranked within the top 100 in NIRF in overall, category-specific, or domain-specific rankings.

- State government HEIs ranked between 101-200 in NIRF are also included.

- All central government institutions are eligible.

- The list of eligible colleges will be updated annually based on the latest NIRF rankings.

Benefits of PM Vidyalaxmi Scheme

Benefits of PM Vidyalaxmi Scheme are as follows:

- Under this scheme there is no need for a guarantor or collateral to secure education loans.

- Loans cover full tuition fees and other course-related expenses.

- Interest subvention:

- 3% interest subsidy on loans up to Rs. 10 lakh for students with family income less than Rs. 8 lakh.

- Full interest subvention for students with family income less than Rs. 4.5 lakh.

- 75% credit guarantee for loans up to Rs. 7.5 lakh, reducing the risk for banks.

- Easy, transparent, and entirely digital loan application process.

- The scheme benefits students in top institutions ranked under NIRF, promoting access to quality education.

- The scheme is expected to benefit over 22 lakh students annually.

Eligibility Criteria for Students

Eligibility criteria for students are as follows:

- Open to Indian nationals pursuing higher education in eligible institutions within India (not abroad).

- Family income must be up to Rs. 8 lakh per annum to qualify for interest subvention and benefits.

- Applicable to students admitted to top 100 NIRF-ranked HEIs (government or private) in overall, category, or domain-specific rankings.

How to Check PM Vidyalaxmi Scheme College List?

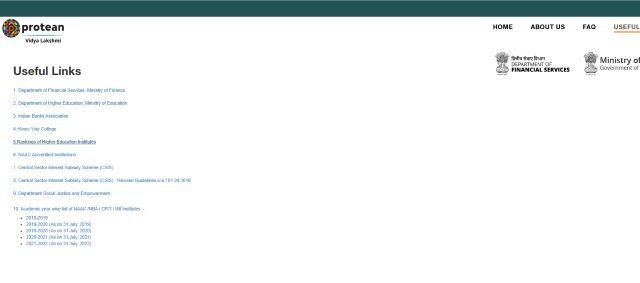

To check the PM Vidyalaxmi Scheme College List, please follow the below-mentioned steps:

Step 1: Visit the Vidyalakshmi Website.

Step 2: On the homepage, click on the “USEFUL LINKS” option in the menu bar.

Step 3: Select “Rankings of Higher Education Institutes” from the links.

Step 4: You will be directed to the NIRF Portal, click on the “RANKING” option in the menu.

Step 5: Click on the “Colleges” option.

Step 6: The PM Vidyalaxmi Scheme College List 2024 will appear on your screen.

PM Vidyalaxmi Scheme College List Download PDF

The PM Vidyalaxmi Scheme College List Download PDF follows as:

FAQs

What is the PM Vidyalaxmi Scheme?

PM Vidyalaxmi Scheme provides financial support to meritorious students through collateral-free, guarantor-free education loans, enabling them to pursue higher education in India’s top institutions.

Who is eligible for the PM Vidyalaxmi Scheme?

Indian students with a family income of up to Rs. 8 lakh per annum, admitted to top 100 NIRF-ranked institutions in overall, category, or domain-specific rankings.

How much loan can be availed under the scheme?

Students can avail of loans up to Rs. 10 lakh, with a 75% credit guarantee for loans up to Rs. 7.5 lakh.

Is there an interest subvention available?

Yes, students with a family income of up to Rs. 8 lakh are eligible for a 3% interest subsidy on loans up to Rs. 10 lakh. Full interest subvention is available for those with family income up to Rs. 4.5 lakh.

Are loans available for studies abroad under this scheme?

No, the PM Vidyalaxmi Scheme is only applicable for students pursuing higher education in India.

How can students apply for the PM Vidyalaxmi Scheme?

Students can apply through the unified PM-Vidyalaxmi portal, where they can access the loan application and interest subvention options in a digital, streamlined process.

What is the purpose of the PM Vidyalaxmi Scheme?

The scheme aims to remove financial barriers for students from economically weaker families, enabling them to access quality higher education in India’s top institutions.