There are many people from Karnataka state who are suffering from economically disadvantaged conditions and because of this they cannot get proper employment or start their own business. To promote the new entrepreneurs of the state and encourage people to start their own businesses the Government of Karnataka has started the Shrama Shakti Scheme. The Sharma Shakti scheme will offer financial loans of up to rupees 50,000 to the minority community people of Karnataka who want to start their own businesses. Under the Sharma Shakti scheme, the minority community people will also get artistic or Technical skills training which will help them and their career planning. The amount of the loan should be returned in the duration of 36 months. If the candidate is capable of returning half of the loan amount in 36 months then, the other half loan amount will be recognised as back end subsidy.

About Shrama Shakti Scheme

The Sharma Shakti scheme is an initiative of the Karnataka government for the minority community people of the state to help them to start their own businesses or work as an entrepreneur. The main department for this scheme is Karnataka Minorities Development Corporation Limited. Under the Sharma Shakti Scheme, the candidates will get financial loans of Rs. 50000 which should be returned in the duration of 36 months. There will be a 4% interest rate which will be added in the loan amount. The candidates will also get training to learn artistic or technical skills. The age of Candidate should be in between 18 to 55 years with financial assistance should not be more than 3.50 lakh per annum. If any of the candidate’s family members are involved in the Central/ State/ Government Sector Unit then they are not eligible for the scheme.

Also Read: Karnataka CM Self Employment Scheme

Objective of the Shrama Shakti Scheme

The main aim of implementing the Sharma Shakti Scheme is to motivate and encourage the unemployed youth of Karnataka to start their own business or to become an entrepreneur to establish their career in a good part and also provide Employment opportunities for other youth. Employed and financially because of which they cannot get proper employment or job to support their family. For financial help such as candidates, the Karnataka government has created this Sharma Shakti scheme in which they will offer a financial loan of rupees 50000 to the Eligible candidates which they have to return in 36 months. If the candidate returns half of the financial amount then the other half amount which is Rs.25000 will be recognized as the back-end subsidy.

Key Highlights of the Shrama Shakti Scheme

| Launched By | Government of Karnataka |

| Name of Scheme | Shrama Shakti Scheme |

| Objective | To motivate and encourage the unemployed youth of Karnataka to start their own business |

| Benefits | Financial loan of up to Rs. 50,000 |

| Eligibility Criteria | Candidate should be in between 18 to 55 years |

| Interest Rate | 4% |

| Official Website | Shrama Shakti Portal |

Eligibility Criteria for Shrama Shakti Scheme

- Candidate must be a permanent resident of Karnataka state.

- Candidate should belong to a minority community such as;

- MuslimChristianJainBuddhismSikh

- Parsi

- The age of the Candidate should be between 18 to 55 years with financial assistance should not be more than 3.50 lakh per annum.

- If any of the candidate’s family members are involved in the Central/ State/ Government Sector Unit then they are not eligible for the scheme.

- In the previous five years, not a single person from a candidate’s family or candidate may have received benefits under any other KMDCL program (other than the Arivu Scheme).

- The candidate must not have a history of KMDC loan defaults.

Also Read: KMDC Loan Status

Benefits of Shrama Shakti Scheme

- The Sharma Shakti scheme is an initiative of the Karnataka government for the minority community people of the state to help them to start their own businesses or work as an entrepreneur.

- Under the Sharma Shakti scheme, the candidates will get financial loans of Rs. 50000 which should be returned in the duration of 36 months.

- There will be a 4% interest rate which will be added to the loan amount.

- The candidates will also get training to learn artistic or technical skills.

- If the candidate returns half of the financial amount then the other half amount which is Rs.25000 will be recognized as the back-end subsidy.

Documents Required

- Income Certificate.

- Aadhar Card.

- Project Report.

- Passport Size Photo.

- Self Declaration Form.

- Surety Self Declaration Form.

- Bank Account Details.

- Online Application Form.

- Residence Proof of Karnataka.

- Minority Certificate.

- Caste Certificate.

Reward Details

- Under the Sharma Shakti Scheme, the candidates will get financial loans of Rs. 50000 which should be returned in the duration of 36 months.

- If the candidate returns half of the financial amount then the other half amount which is Rs.25000 will be recognized as the back-end subsidy.

- There will be a 4% interest rate which will be added to the loan amount.

Application Process for Applying under the Shrama Shakti Scheme

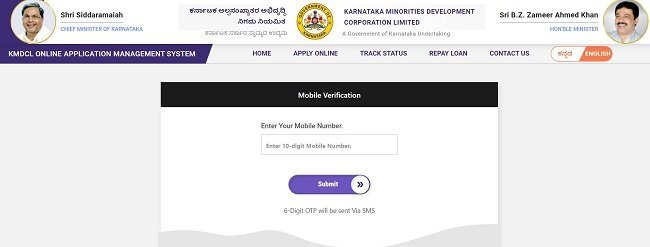

- Applicants first need to visit the Official KMDC Website of Karnataka Minorities Development Corporation Limited.

- The homepage will appear on your screen, here you need to click on the Application Form option.

- Here you need to enter your Mobile number for verification. After that you need to enter the following details:

- Name

- DOB

- Annual income

- Community, etc.

- After filling all these details you need to click on the Print Application form option.

- Now attach the documents with your application form and submit it to the District Selection Panel.

Contact Details

- Address: No. 39-821, 2nd Floor, K M D C BHAVAN, Subedar Chatram Road, Sheshadripuram, Bengaluru – 560020, Karnataka.

- Phone Number: 080-22860999 & 080-22861226

- Email id: kmdc.ho.info@gmail.com

FAQs

The age of the Candidate should be between 18 to 55 years with financial assistance should not be more than 3.50 lakh per annum.

Under the Sharma Shakti scheme, the candidates will get financial loans of Rs. 50000 which should be returned in the duration of 36 months.

There will be a 4% interest rate which will be added to the loan amount.