On August 15, 2014, our nation’s Prime Minister, Shri Narendra Modi, announced the Pradhan Mantri Jan Dhan Yojana, and on August 28, the program was officially launched. This program intends to give everyone access to financial services such as banking, savings and deposit accounts, remittance, credit, insurance, and pensions at a reasonable price. The Central Government recently included a section for young children. Now, applicants may also request a bank account for a child who is older than 10 years old. Candidates can apply for this by visiting the official links for any bank branch or the website for the post office. If you want to learn more about the Pradhan Mantri Jan Dhan Yojana 2025, including its highlights, objectives, features, benefits, eligibility requirements, application procedures, and much more, then continue to read this post.

About Pradhan Mantri Jan Dhan Yojana

Pradhan Mantri Jan Dhan Yojana is a national mission on financial inclusion that employs a coordinated strategy to achieve full financial inclusion for all families in the nation. The plan calls for financial literacy, access to credit, insurance, and pension services, as well as universal access to banking services with at least one basic banking account for every family. The recipients will also receive a RuPay Debit card with a built-in 1 lakh rupee accident insurance policy. The plan also calls for promoting the Union Government’s Direct Benefits Transfer (DBT) program and directing all government benefits (from the Center, States, and Local Bodies) into recipients’ accounts. Additionally, an attempt is being made to engage the nation’s youngsters in this Mission Mode Program.

Also Read: Post Office Saving Scheme

Objectives of Pradhan Mantri Jan Dhan Yojana

The “Pradhan Mantri Jan-Dhan Yojana (PMJDY)” aims to ensure that the excluded sections, such as weaker sections and low-income groups, have access to a variety of financial services, such as the availability of a basic savings bank account, access to need-based credit, remittances facility, insurance, and pension. Only with the efficient application of technology is this extensive penetration at a reasonable price conceivable.

The following are the scheme’s primary goals:

- All people can use banking services.

- Sustainable development, financial literacy, and independence are all increasing.

- Coverage for accidents as a type of microinsurance

- A Rupay debit card makes it easier to access personal cash.

- There is a pension programme for the unorganized sector in India.

- Access to credit and need-based financial aid is made possible via an overdraft facility.

- The simplest kind of savings accounts

- Long-dormant accounts are being revived to give current account holders a fresh start.

Key Highlights of Pradhan Mantri Jan Dhan Yojana

| Launched By | Pradhan Mantri Narendra Modi |

| Name of Scheme | Pradhan Mantri Jan Dhan Yojana |

| Objective | Access to a variety of financial services, such as the availability of a basic bank savings and account |

| Benefits | One basic savings bank account is opened for unbanked person |

| Eligibility Criteria | The age range for candidates must be between 18 and 59 years |

| Beneficiaries | Citizens of India |

| Official Website | PMJDY |

Benefits of Pradhan Mantri Jan Dhan Yojana

- To take part in the programme, participants are not needed to maintain a minimum balance.

- Interest is paid on savings account deposits made under the scheme.

- In the event of death, the beneficiary would be protected for Rs.30,000 if the account was created between August 20, 2014, and January 31, 2015.

- If individuals maintain good standing in their accounts for six months, an overdraft facility is offered.

- Individuals are given Rs. 1 lakh in accidental insurance coverage under the RuPay system.

- The family receives a Rs. 5,000 overdraft facility for one account. This service is often provided to the lady of the home.

- The Direct Benefit Transfer option is available to anyone who receives government benefits.

- The program provides access to pensions and insurance policies.

- Account holders can check their balances using the mobile banking tool.

- Personal Accident protection cannot be used until a successful non-financial or financial transaction has been made by the RuPay Cardholder. Transactions made under the plan are deemed PMJDY eligible if they are completed within 90 days after the accident. However, the transaction must be finished at an E-COM, POS, ATM, Bank Mitra, bank branch, or a venue like that.

Features of Pradhan Mantri Jan Dhan Yojana 2025

- Under the PMJDY programme, each unbanked individual receives one basic saving bank account.

- The basic savings bank account has no minimum balance requirement.

- The account holder will receive a Rupay debit card.

- Account holders have access to a 10,000 rupee overdraft option. But you have to be in the age range of 18 and 65. After the account has been open for six months, you can apply.

- A person or entity that represents a bank is referred to as a bank representative or a bank mitra. They’re allowed to offer fundamental banking services both in rural and urban locations.

- Account holders also receive an accident insurance policy along with their Rupay card. The accidental coverage is available up to Rs 2 lakh if the account was started after August 28, 2018. In the event that the account was created prior to August 28, 2018, the coverage is restricted to Rs 1 lakh.

- The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Atal Pension Yojana (APY), Direct Benefit Transfer (DBT), Pradhan Mantri Suraksha Bima Yojana (PMSBY), and Micro Units Development & Refinance Agency Bank (MUDRA) are a few of the current programmes.

- Owners of PMJDY accounts can also access other social security programmes.

- Public sector banks, regional rural banks, and private sector banks all offer financial services under the PMJDY system.

- An Indian citizen is required to open an account. A guardian’s assistance is required for a minor to open an account.

- Accounts under the PMJDY scheme typically have an interest rate of around 4%. However, this interest rate may vary often.

- You are permitted to withdraw up to Rs 10,000 using your Rupay debit card. Additionally, you are permitted up to four ATM withdrawals each month.

Eligibility Criteria

Candidates who wish to apply for the Pradhan Mantri Jan Dhan Yojana must meet the requirements for eligibility established by the Indian government. The following are the requirements for participation in the Pradhanmantri Jan Dhan Yojana 2022:

- The applicant must have opened a bank account for the very first time in his or her life.

- The applicant can only benefit from this scheme if he is the family’s head or the family’s earning member

- The applicants must be between the ages of 18 and 59 years

- This scheme is not available to citizens who pay taxes.

- Employees of the central or state governments are not eligible for this program.

- This program is not available to retirement central or state government employees.

Documents Required

The applicants will need to provide a few documents when completing the Pradhanmantri Jan Dhan Yojana application; be sure to have these on available. The following documents are necessary for the Pradhanmantri Jan Dhan Yojana 2022:

- Aadhaar Card

- Passport

- PAN Card

- Job card issued by National Rural Employment Guarantee Act (NREGA)

- Driving license

- Voter ID

- Identity card with photo

- Attested photograph

List of Banks that Provide Pradhanmantri Jan Dhan Yojana

| Private Sector Banks | Public Sector Banks | Public Sector Banks |

| Dhanalaxmi Bank Ltd. | Oriental Bank of Commerce | Union Bank of India |

| ING Vysya Bank Ltd | Punjab National Bank (PNB) | Vijaya Bank |

| YES, Bank Ltd. | State Bank of India (SBI) | Dena Bank |

| Kotak Mahindra Bank Ltd. | Bank of Baroda (BoB) | Syndicate Bank |

| Karnataka Bank Ltd. | Bank of Maharashtra | Punjab and Sind Bank |

| HDFC Bank Ltd. | Allahabad Bank | Corporation Bank |

| IndusInd Bank Ltd. | IDBI Bank | Indian Bank |

| Federal Bank Ltd. | Union Bank of India | Andhra Bank |

| ICICI Bank Ltd. | Central Bank of India | Bank of India |

Application Procedure of under Pradhan Mantri Jan Dhan Yojana 2025

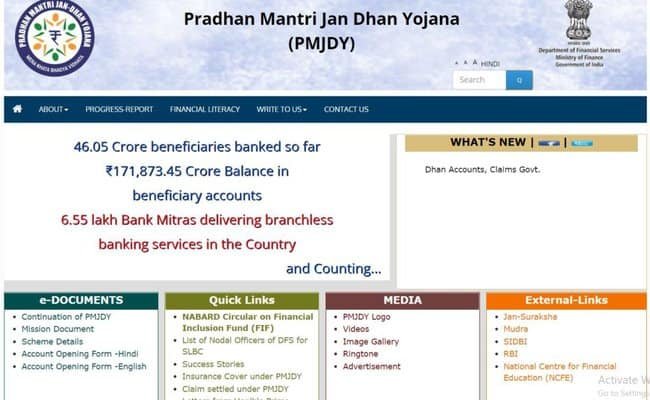

- The Applicant first visits the PMJDY Website of Pradhan Mantri Jan Dhan Yojana.

- The homepage will open on your device, where you click on the Account opening form – Hindi and the Account opening form – English as per your preference.

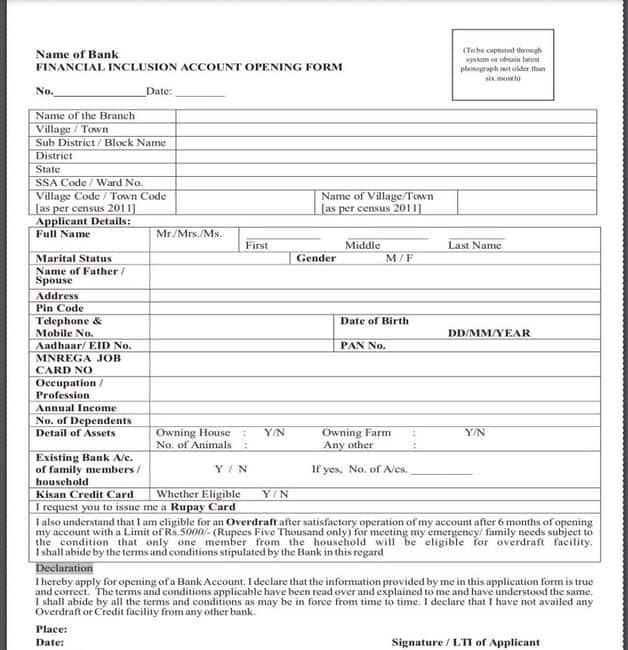

- After that application form will open where you need to fill all the details such as:

- Bank Name

- City

- Block Name

- District

- State

- Ward No.

- Village/Town Code

- Applicant Name

- Marital Status

- Father’s Name

- Occupation

- Annual Income, etc.

- After filling all the required information and attaching documents submit the form to bank concerned authority.

Contact Details

Please feel free to get in touch with us at the following information for further information or if you have any questions or complaints about the Pradhanmantri Jan Dhan Yojana 2022.

Address:

- Pradhanmantri Jandhan Yojana, Department of financial services, Ministry of Finance, Room number 106, 2nd floor, Jeevandeep building, Parliament Street, New Delhi-110001

- Helpline Numbers: 1800110001, 18001801111