If you are worried about your retirement then the post office authorities have come up with the post office monthly income scheme 2025 which is the best five-year investment plan with a maximum ceiling of rupees 4.5 lakh for a single person and 9 lakh for a joint account. You can check out the details related to the Post Office Monthly Income Scheme 2025 from the article provided below and we will also share with you all the details related to the account and the step-by-step procedure through which you will be able to fill out the application form for this scheme. You can also check out the details related to the interest rate and the eligibility criteria that you need to follow to be a part of this prestigious program and apply for this prestigious program to secure your old age.

About Post Office Monthly Income Scheme

Post Office India provides a lot of opportunities for the residents so that they can invest in different types of income schemes so that their retirement plans are activated. The applicants can now apply for the post office depository service available by the Indian government so that they can get proper income opportunities after they have attained old age and are not able to continue their livelihood because of the various health opportunities. You can check out the details related to the Post Office Monthly Income Scheme by visiting your nearest post office and then you can fill out the application form available by the concerned authorities to be a part of this prestigious scheme. The interest rate in this scheme is 6.7% for residents of India.

Also Read: Post Office Saving Scheme

Features Of Post Office Monthly Income Scheme

The official post office monthly income scheme has the following features available for the residents who are applying for this scheme:-

- There is a lock-in period of 5 years.

- You can make a maximum investment of rupees 4.5 lakh. The maximum limit for minors is Rupees 3 lakh and the minimum amount for individuals is Rupees 1500.

- You can transfer your account from one post office to another.

- A maximum of three people can open a joint account in this scheme and the maximum limit for joint accounts is Rupees 900000 and the singular limit is Rupees 4.5 lakh.

- You can open the account in the name of your child above the age of 10 years and they can withdraw the amount when they are above the age of 18 years.

- A penalty will be charged if you withdraw your investment before the lock-in period.

- You can invest any multiple of rupees hundred as an investment.

Benefits Of the Post Office Monthly Income Scheme

A lot of benefits will be available if you are applying for the post office monthly income scheme because it is not a market link investment scheme and the guarantee of this scheme is presented by the concerned authorities of the Indian government for all the people who are investing their money. This is a very low-risk scheme presented by the Indian Government and you would earn a study flow of income every month on your investment it respective of the market fluctuation through the development of the scheme. The interest rate in this scheme is 6.7% per annum fixed by the post office authorities. You can also reinvest your money after you have taken benefit of this scheme to get equity or debentures from prestigious companies in India.

Interest Rate

The applicant will get an interest of 6.7% through the implementation of this scheme. But if you are withdrawing the policy within 1 year you will get zero benefits. If you are withdrawing in 1 to 3 years then the deposit will refund with a two percent penalty. If you are withdrawing from the fourth year to the fifth year then the deposit will refund with a one percent penalty.

Eligibility Criteria

The applicant must follow the following eligibility criteria to apply for this scheme:-

- The applicant must be an Indian resident.

- The applicant must be above the age of 18 years but in the case of minors, the minor must be above the age of 10 years.

- The minor can access his or her account after they have reached the age of 18 years.

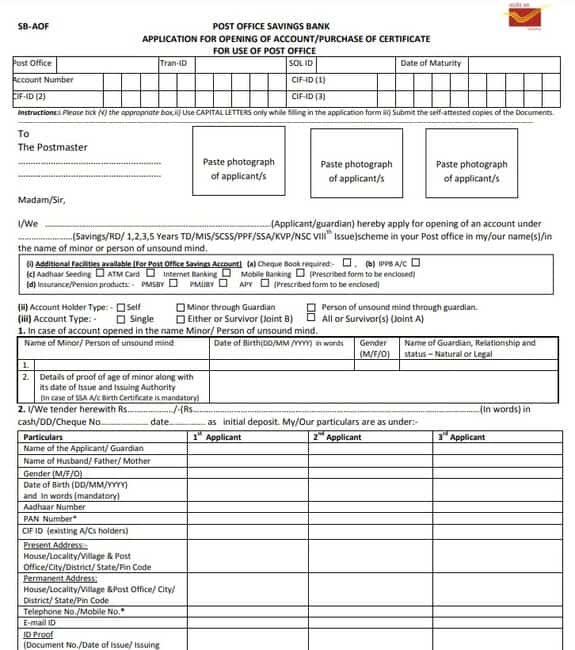

Documents Required

The following documents are required to apply for this scheme:-

- Identity proof including

- Passport

- Voter ID

- Driver’s License

- Aadhar Card

- Address proof including

- Government-issued ID cards

- Electricity bill

- Passport size photographs

Also Check: Kisan Vikas Patra

Online Application Process

To apply for this scheme you will have to follow the simple procedure given below:-

- You will first have to visit your nearest post office and then you will have to ask for the application form for the post office monthly income scheme account.

- You have to fill out the application form and submit the application form to the concerned authorities by attaching all of the documents mention above.

- The applicant will have to submit the original documents to go through the verification procedure.

- You have to collect the signatures of your witnesses and the beneficiaries and then you will be eligible to get the details related to this prestigious scheme presented by the post office department.