PAN, or Permanent Account Number, is a one-of-a-kind alphanumeric code provided to all companies conducting financial transactions in India. Individuals and businesses use it to file income tax returns and conduct high-value transactions (mostly for amounts exceeding Rs. 50,000). Checking the status of a PAN Card can be done in a very short and basic method. After applying for a PAN card or requesting an update or correction of inaccuracies on your PAN, you will be given an acknowledgment number. This number can be used to track the status of your new PAN application or the rectification of your PAN Card Status 2025. Continue reading to learn more about tracking PAN card delivery status and the many methods available.

What Is PAN Card Status 2025?

A PAN card is a vital document that all income taxpayers must register for and apply for. The most common way to verify the status of your application is to use your 12-digit Aadhaar number. You can check the status of your PAN Card Status Aadhaar number as well as the 15-digit acknowledgment number supplied at the time of enrollment. Furthermore, the Indian government has mandated that residents link their Aadhaar card with their PAN card to file Income Tax (IT) reports and access other services. As a result, enrolling in both of these papers is critical. However, what if you applied for a PAN card but never got one? Or perhaps you just updated some information and got no response? Tracking the status of your card is all you need to do;

Also Read: E Aadhaar Download

Key Highlights of Status

| Issued By | Indian Income Tax Department |

| Name of Post | PAN Card Status 2025 |

| Objective | To introduce a standard form of identity into all financial dealings |

| Benefits | A single stop to check the PAN details and also save time |

| Eligibility Criteria | The applicant must applied for PAN Card |

| Mode | Online |

| Official Website | PAN Card |

The objective of PAN Card Status

The main goal of checking status is to provide convenience to the applicants, so they can check the progress of their card through the online portal. PAN’s mission is to provide a common identifier for all financial transactions and to combat tax evasion by monitoring financial activity, particularly that of high-net-worth persons who have a significant impact on the economy. When submitting income tax returns, deducting taxes at source, or corresponding with the Income Tax Department in any other way, you must include the PAN. PAN is also increasingly required to create new bank accounts, demat accounts, landlines, or mobile phone connections, buy foreign currency, make bank deposits greater than $50,000, buy and sell immovable property, automobiles, etc.

Benefits of PAN Card Status

The main advantage of status is that it will make the process of analyzing the progress of your PAN Card very easy. You can easily check the status by sitting at your home or office. It will save you time and effort. After the implementation of this online service, you don’t need to visit the PAN Card office near your locality. It’s just a one-click process.

Eligibility Criteria

- The applicant must be a resident of India to apply for a PAN Card.

- And to check the status the candidate must apply for it earlier.

Also Check: Link Aadhaar Card

Check PAN Card Status on the UTI Website

To check the status of your UTI card online using your coupon number, follow these steps:

- Applicants need to check out the PAN Card webpage of PAN Card.

- The homepage will appear on your screen.

- On homepage you have to input the PAN or application coupon number.

- Enter your birthdate, incorporation date, contract date, etc.

- The status of your PAN card will now appear on the screen once you click “Submit.”

- The PAN card must be obtained within 15 business days of the request being submitted.

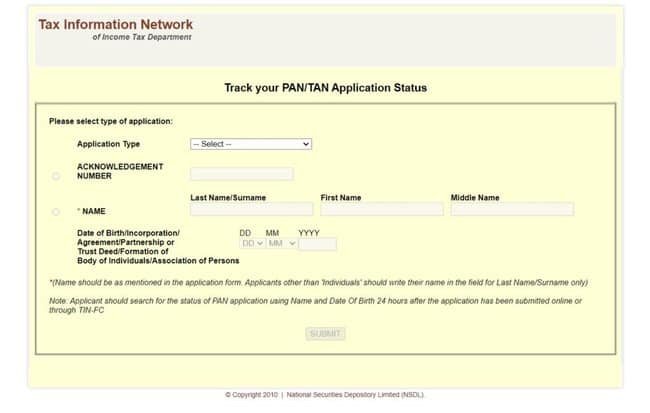

Status of PAN Cards by Acknowledgement Number

- The procedures listed below can be used to determine the status of a transaction you completed using your PAN Card:

- Visit NSDL’s official website to find out more information.

- A homepage will then appear for you. There is a “Track PAN Status” option on the home page. Just click it.

- In the following step, select “PAN-New or Change Request” under “Application Type.”

- Your acknowledgment number is 15 digits long; kindly enter it in the area provided.

- Just click “Submit” to send the form.

- Your screen will display the current status of your PAN Card application.

If you don’t have Acknowledge Number

- Applicants first need to visit the TIN-NSDL official website.

- The homepage will appear on your screen, where you have to click on Application Type Section, then click on NEW/Change Request from the drop-down menu.

- If you don’t have an acknowledgment number, you can pick the Name section to see the current status of your PAN card.

- Please make sure to provide your entire name, middle name, and birthdate.

- Click the “Submit” button now to check the status of your PAN card.

How to Check a PAN Card’s Status Using a Mobile Number

Along with your recognized number, your mobile number is also included in this stage.

- You’ll need to go to your mobile device’s home screen to get started.

- The next step is to dial 020-27218080.

- You must enter a 15-digit acknowledgment number as the next step.

- Following that, it would be simpler for you to check the status of your PAN card.

Verification of Aadhaar Numbers for PAN Card Status

- You must first visit the official website, which can be done by clicking the following link.

- You will next be asked to enter your 12-digit Aadhaar number.

- You will additionally need to input the captcha code in addition to supplying this number.

- Make sure to hit the submit button once you’ve finished filling out the form.

- A window displaying your current status will appear on your display screen when you click it.

How to Use a Mobile App to Check the Status of Your PAN Card

- You must start by visiting the Google Play Store.

- You must download and set up the PAN Card mobile app on your smartphone.

- Open this application on your smartphone.

- You must select the “Know your PAN Details” option when the window first appears.

- You must fill out the following page with all the necessary data in the right format.

- After that, an OTP will be issued to the telephone number you entered.

- You will need to click the submit button after entering the OTP.

- This solution allows you to check your status on a mobile application.

Status of PAN Cards by Name and DOB

- Go to the Income Tax Department official website first.

- The homepage will now show up.

- Go to the homepage’s “Quick Links” section.

- Select “Confirm your PAN information.” A form will then show up.

- On the following page, enter your PAN, name, and birthdate.

- Enter the captcha after selecting your status.

- Then press “Submit.”

Contact Details

- Aaykar Sampark Kendra (ASK) - 18001801961/1961

- PAN/TAN – +912027218080