The National Saving Certificate is a Post Office Savings Program that also reduces income taxes because deposits are eligible for section 80C of the Income Tax Act deductions. The Indian government is responsible for the NSC plan. It guarantees returns as a consequence. Investors with low and middle-class salaries are encouraged to save through this savings bond. They can be qualified for tax relief as well. Risk-averse investors or those looking to diversify their portfolio through fixed-return instruments typically select NSC. NSC investments up to Rs 1.5 lakh are tax-exempt under Section 80C of the Income Tax Act. They are locked in for five years. NSC certificates earn fixed interest. The interest rate at the moment is 6.8%. In this post, we provide you with more information regarding the NSC 2022.

About National Saving Certificate 2025

The Public Provident Fund (PPF), Kisan Vikas Patra (KVP), Sukanya Samriddhi Yojana, Post Office Savings Account, Recurring Deposit (RD) Account, Senior Citizen Saving Scheme (SCSS), Time Deposit (TD) Account, and Monthly Income Scheme are among the other schemes the NSC Interest Rate Chart demonstrates that the NSC interest rate is on par with (MIS). People can now compare and check the differences between the nsc, ppf, kvp, ssy, scss, mis, rd, td, and post office savings accounts. The minimum investment amount in National Savings Certificates is Rs. 1000, and multiples of Rs. 100 are also acceptable. There is no maximum investment amount. The interest rate on National Saving Certificate in 2022 is fix at 6.8% (effective October 1, 2022), compounds annually, and may check using the National Savings Certificate Calculator.

Key Highlights of National Saving Certificate

| Launched By | Government of India |

| Name of Post | National Saving Certificate 2025 |

| Objective | A Post Office Savings Plan that reduces income tax |

| Benefits | There is no maximum amount that can be invested |

| Eligibility Criteria | An adult |

| Registration | Online |

| Official Website | National Saving |

Objective of National Saving Certificate

A National Savings Certificate’s NSC interest is compounded once a year. At the end of the five years, the investor will receive the interest. The interest earned is reinvested each year. You can enter the investment amount, the term (which is already set at five years), and the interest rates in the NSC Calculator 2025. The tool will then calculate the entire return on the investment when it reaches maturity. The calculator is a quick way to find out how much you will get when you reach maturity. Without wasting any more time, you may quickly determine if the strategy is in line with your financial objective.

Benefits of National Saving Certificate

An NSC’s interest and maturity amount might be complicated and time-consuming to calculate. Once a year, the interest is compounded. The interest earned on the investment is reinvested. After five years, the investor gets both the interest and the principle. An investor’s need to know how much their stake in NSC has grown is understandable. The following are a few advantages of utilizing the calculator:

- It is simple to use and understand.

- It might save you time compared to performing the computations manually.

- The calculations are correct; you do not need to double-check them.

- You can use it for nothing and from any location you choose.

National Savings Certificate Tax Benefits

Due to the following factors, subscribers should invest in the National Savings Certificate Scheme:-

- On income up to Rs. 1.5 lakh, people can avoid paying income tax.

- The National Savings Certificate Calculator can be used to check the guaranteed Interest Rate of 6.8% per year offered by NSC.

- The National Savings Certificate has a 5-year maturity period.

- This savings plan is conveniently offered at all Post Offices.

- In addition, interest is compounded annually and is automatically reinvested.

- Interest collection is added to the initial investment and is also eligible for a tax reduction along with the income tax rebate. For instance, if someone buys an NSC Certificate for Rs. 1000, they will receive a tax reduction on their initial investment in the first year.

Features for National Saving Certificate

In the past, there were two tenures for NSCs: 5 years (NSC VIII) and 10 years (NSC IX). Only the 5-year NSC VIII is presently available for subscription due to the termination of NSC IX. The following are the main aspects of NSC VIII:

- A National Savings Certificate with a fixed maturity of 5 years can be simply acquired at any Indian Post Office.

- According to announcements made by the Ministry of finance, interest rates may occasionally vary.

- The minimum investment amount for a National Savings Certificate is Rs. 1000 (and multiples of Rs. 100), but there is no maximum investment amount.

- Up to Rs. 1.5 lakh per year, the invested principal is eligible for tax savings under Section 80C of the Income Tax Act, 1961.

- All of the major banks and NBFCs properly accept National Savings Certificates as security or collateral against secured loans.

- In the event of the investor’s untimely passing, he or she may nominate any family member—including minors—to inherit his or her NSC investments.

Holding National Savings Certificates in Different Ways

The following are the several ways to hold National Savings Certificates:-

- Single Holder Type Certificate: An investor may buy a single holder certificate for themselves or a minor.

- Joint A Type Certificate: In this situation, two investors hold the certificate and will each receive an equal portion of the maturity proceeds.

- Joint B Type Certificate: Although this certificate is a joint holding one, only one of the holders will get the maturity proceeds.

Documents Required

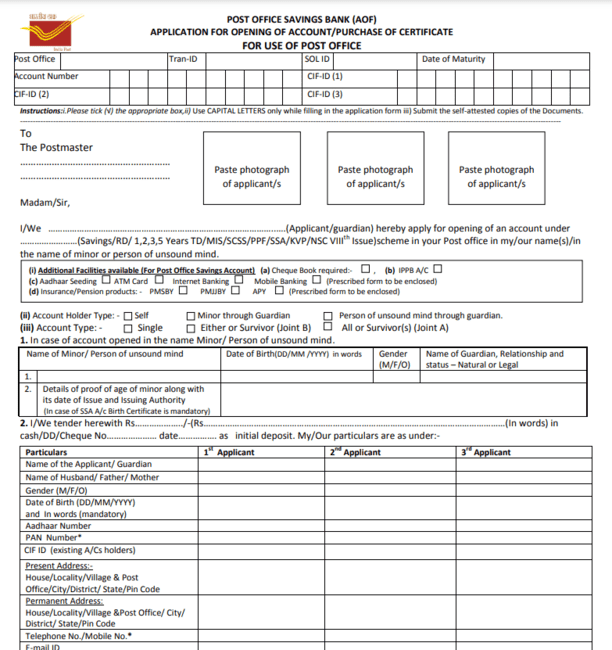

- Fully completed NSC Application form

- Recent picture

- Identity evidence such as a PAN or Aadhaar card

- Address evidence- Aadhaar cards, voter identification, etc.

- Deposit of the investment amount in cash or a check

Payment for National Savings Certificates – NSC Purchase

To purchase an NSC account, the buyer must complete Form A. Buyers may pay for this using cash, a check, a pay order, or a demand draught made out to the postmaster. Additionally, candidates may pay using monies from their Post Office Savings Bank Account.

In light of this, the Postmaster will either immediately issue a new NSC Certificate or offer a provisional slip for certificate purchase. These certificates for the National Savings Scheme (NSS) may also transfer from one post office to another.

Issue and Maturity of National Savings Certificates

After five years have passed since the deposit’s date, the deposit will mature. Both the NSC VIII Issue and NSC IX Issue are under the NSC umbrella. NSC IX Issue was stopped by the central government in December 2015. As a result, only NSC VIII is available for subscription and has a 5-year lock-in duration. The subscriber must pay the necessary tax on the total maturity value because there is no TDS applied to the interest earned.

Loan on NSC Issue – Individuals may also obtain loans from banks in exchange for their National Savings Certificates Scheme NSC investments. Due to this, the subscriber must transfer their certificate into the name of the bank they are applying for a loan from.

Facility for NSC Nomination and Issuance of a Duplicate Certificate

When making a purchase, individuals can nominate and choose their nominee by completing Form 1 or Form 2 before the maturity of their NSC. If the original account holder passes away, this nominee is eligible to receive the maturity sum. This candidate has the following operations available to them:- Encash NSC at any time before or after NSC Maturity.

- Cash in the NSS Certificate for the National Savings Scheme.

- NSC Certificates are divided into appropriate denominations in support of specific nominees.

To do this, the nominee must provide a Death Certificate to the Postmaster informing him or her of the original account holder’s passing.

Premature Encashment / Withdrawal of National Savings Certificates

In the event of NSC, premature withdrawal is not applicable. NSC can, however, be cashed out early—before the 5-year mark—under the following circumstances:-

- When one or more account holders in a joint account pass away, whether individually or collectively.

- Upon forfeiture by a pledgee who is an officer with the Gazette.

- Based on a court’s directives.

No interest is paid if a National Savings Certificate Scheme (NSC) account is cashed out within a year. Candidates will receive interest, although at a reduced rate, if the withdrawal occurs after a year.

Eligibility Criteria

The following are the main requirements for investing in National Savings Certificates:

- Investment in NSCs is open to all Indian residents.

- Investors in NSCs may be individuals acting alone or in a group of up to three adults, guardians acting on behalf of a minor, a person of unsound mind, or a minor above the age of ten.

- Indians who are not residents cannot buy brand-new NSCs. However, such NSCs can be kept until maturity if resident NSC subscribers become NRIs before the maturity of the certificates.

- Neither trusts nor Hindu Undivided Families (HUFs) may invest in NSC.

- Only in his name can Karta of HUFs invest in NSC.

Also Read: Post Office Saving Scheme

Steps for Offline Investment in National Savings Certificates

Any Indian Post Office will sell NSC upon receipt of the necessary KYC documentation. The essential steps for investing in National Savings Certificates are as follows:

- Complete the NSC application form, which is accessible both online and at all Indian post offices.

- The necessary KYC documents must be submitted in self-attested copies. The original documents must be brought along as well for additional verification.

- Make a cash or check payment of the amount to be invested.

- NSCs of the appropriate quantities will be printed after the purchase of certificates is processed, and they may be picked up at the post office.

How to Invest Online in NSC

The steps for opening an NSC account online are as follows:

- Access DOP online banking

- Select “Service Requests” from the “General Services” area, then “New Requests.”

- “NSC Account – Open an NSC Account (For NSC)” should be chosen.

- Choose your debit account that is linked to your PO savings account and enter the NSC minimum deposit amount.

- After reading and agreeing to the terms and conditions, click “Click Here” to finish submitting the online application.

- Click “Submit,” enter the transaction password, and then read or download the deposit receipt.

- You can log in once more and visit the “Accounts” area to see the specifics of the NSC account that was opened. Additionally, the NSC will be opened in the name of the DOP online banking user using the nominee listed in the associated Post Office savings account.