A national pension scheme is an initiative of the Government of India. It is a pension cum investment scheme. This initiative has been started with the objective to provide financial security to the citizens of the country during old age when they are not able to earn their own livelihood by themselves. In this article, you will get detailed information about the National Pension Scheme including eligibility criteria, the interest rate calculator application process and many more.

What Is National Pension Scheme?

The National Pension Scheme is regulated by the Pension fund regulatory and Development Authority. The authority has established the National pension system as a registered owner of all assets under NPS. The scheme can be classified into two categories:

- Government sector

- Central government: From 1st January 2004, the scheme has been implemented by the central government for all employees of central autonomous bodies. Central Government employees contribute to the scheme every month from their monthly salary and a similar contribution is given by the employer of the employee.

- State government: similarly state government has also adopted the scheme. Employees of state government also contribute towards pension from their monthly salary along with matching contribution from the employer of the employee.

- Private sector

- Corporates: A customized version of the scheme which suits the organization and its employees as well has been a doctor in the corporate sector within the purview of their employer-employee relationship.

- All citizens of India: From 1st May 2009, any individual not being covered by the above sectors has been allowed to join NPS architecture under all citizens of India sector.

Also Read: Atal Pension Yojana

Type of NPS account

NPS provides two types of accounts. These accounts are called tier 1 and tier 2.

- Tire 1 account is a mandatory retirement account whereas tier 2 is a voluntary saving account associated with your PRAN.

- You can withdraw from your tiredness to account more flexibly at any point in time.

- You need not pay any kind of additional maintenance charges to get a tire 2 account, even if you do need not to maintain any minimum balance and a separate nomination facility for a tier 2 account is available.

- To open a tire 2 account, you must have a tier 1 account and must be residing in India.

Highlights of the article

- Name of the scheme: National pension scheme

- Launched by: Government of India

- Launched for: citizens of India

- Benefits: pension benefits

- Official website: npscra.nsdl.co.in

Features/ Benefits of NPS

- A National Pension Scheme is an initiative of the Government of India

- A similar contribution is made by the employee and employer both for the Pension fund

- Advantages of portable account

- Customized investment options

- Low-cost structure

- Option to stay invested till 70

- Any individual will get tax benefits under section 80 CCD (1) within the overall selling of rupees 1.5 Lakh. Moreover, an Additional deduction for investment up to rupees 50000 in NPS is available exclusively under subsection 80 CCD (1B)

- Pension funds are responsible for investing contributions accumulating them and managing pension corpus

- Under NPS you can invest with two approaches:

- Active choice: subscribers select the allocation percentage in acid classes

- Auto Choice: funds are automatically allocated amongst a set class in a predefined Matrix based on the age of the subscriber

- Under NPS you can open two types of accounts as detailed above

- NPS subscribers will also get the tax benefits on partial withdrawal, annuity purchase, and on lump sum withdrawal

- You can register up to three nominees for your NPS

- A minor can be a nominee for the NPS

Contribution Criteria

- Tier 1

- Minimum amount per contribution is rupees 500

- The minimum contribution per financial year is Rs 1000

- Minimum number of contributions in a financial- 1

- Tier 2

- The minimum amount per contribution is rupees 250

Eligibility

- Should be an Indian citizen

- Age should be in between 18- 70 years

Requirements For Account Opening Under NPS

- Valid mobile number

- Valid email ID

- An active bank account with a net banking facility

- PAN number/ driving license/Aadhar card

- Canceled cheque scan copy

- Photograph

- Signature

Also Read: Saral Pension Yojana

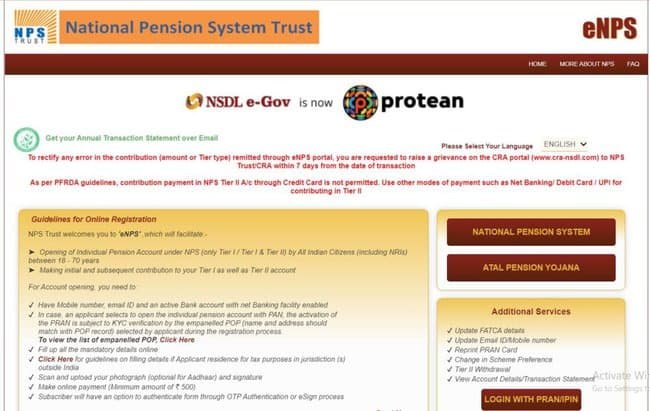

National Pension Scheme Online Registration

- To register you need to visit the National Pension website of the National Pension System Trust

- From the open page you need to choose the National pension system

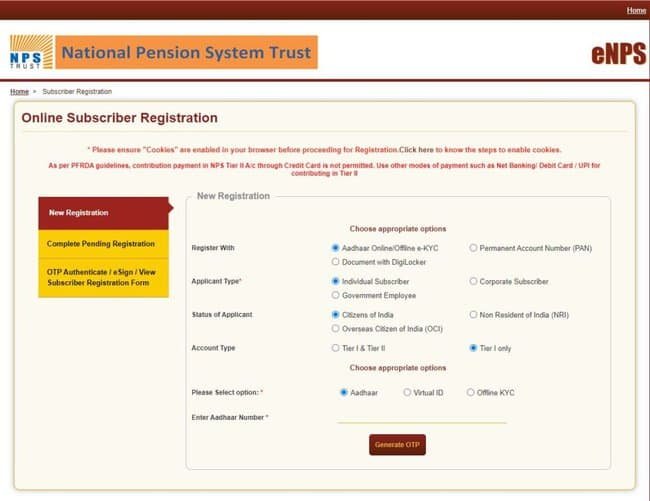

- Now click on the registration option and the application form will open on the screen

- Choose appropriate options as shown on the screen and select any of the following optionAadhaar number/ Virtual ID/ offline KYC

- Enter the details accordingly and click on generate OTP button

- You will receive an SMS along with OTP

- Follow the screen and complete the application form

- Upload the significant documents and submit it

Procedure To Make Subsequent Contribution

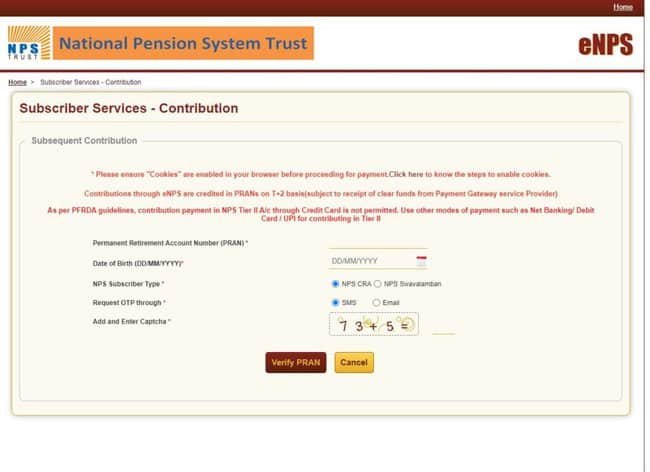

- You need to visit the official website of the National Pension System Trust

- From the home page of the portal, you need to choose the National pension system

- Click on the contribution option and a new page will open on the screen

- Provide the required information such as permanent retirement account number, date of birth, NPS subscriber type, request OTP via and capture code

- Press verify PRAN option and you will receive in OTP

- Enter the OTP and make your contribution by following the screen

Procedure To Get Annual Transaction Statement

- To get the annual transaction statement you need to visit the official website of the National Pension System Trust

- From the homepage of the portal, you need to choose the National pension system

- Now you need to click on the annual transaction statement on email

- A new page will open on the screen where you need to enter your PRAN number

- Enter the capture code shown on the screen and press submit button

- Follow the screen and complete the rest formalities and you will receive the annual transaction statement via email.

Exit/ Withdrawal

A beneficiary can exit or withdraw from NPS in the following conditions

- When he/ she reaches the age of superannuation/ attaining 60 years of age

- In case of premature exit from NPS at least 80% of the accumulated pension of the subscriber has to be utilized for the purchase of an annuity

- The entire accumulated pension would be paid to the nominee/ legal heir of the subscriber in case of death of the subscriber

Procedure To Submit Withdrawal/ Exit Form

You can submit the withdrawal by downloading the application form available on the official portal or by clicking the below available links. You need to submit the withdrawal application along with the necessary documents to the subscriber’s nodal office.

- Exit from National Pension System Due to Superannuation & Incapacitation

- Exit from National Pension System Due to Superannuation & Incapacitation in Hindi

- Exit from National Pension System Due to Premature Exit

- Exit from National Pension System Due to Premature Exit in hindi

- Form for Withdrawal by Claimant due to Death of Subscriber

- Form for Withdrawal by Claimant due to Death of Subscriber in Hindi

- Complete Withdrawal Request Form AP

- Complete Withdrawal Request Form AS

- Form for Partial Withdrawal under NPS

- Affidavit for non submisstion of PRAN Card_subscriber

- Affidavit_For non Submission of PRAN Card_claimant

- Certification of death certificate if received in Vernacular Language

- Indemnity Bond

- Relinquishment Deed

- Request for Continuation or Deferment

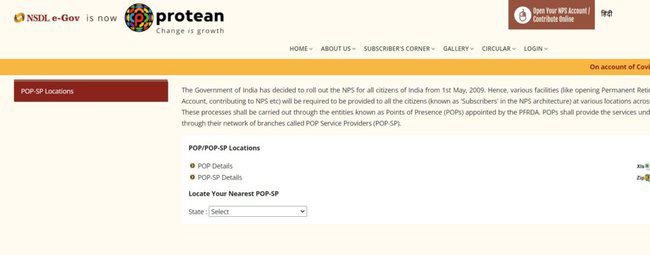

Find Your Nearest POP-SP

- You should open the official website of the NSDL e-Gov portal

- From the home page go to the important links

- Look for the “Find your nearest POP-SP” option

- A new page will open choose the state

- Then choose location and the list will open on the screen

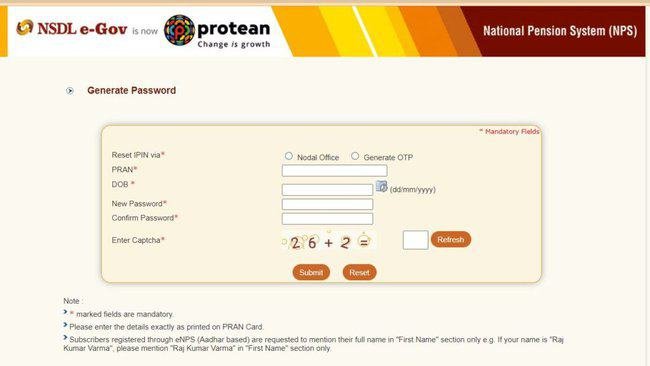

Generate Password

- You should open the official website of the NSDL e-Gov portal

- From the home page go to the important links

- Look for the “Generate Password” option

- A new page will open where you need to enter the following information

- Reset IPIN via

- PRAN

- DOB

- Click To View Calendar (dd/mm/yyyy)

- New Password

- Confirm Password

- Enter Captcha

- Press submit button and the password has been generated

Annuity calculator

- You should open the official website of the NSDL e-Gov portal

- From the home page go to the important links

- Look for the “Annuity calculator” option

- A new page will open select Government Sector Subscriber or Private Sector Subscriber

- Enter the following details like date of birth, gender, marital status, etc.

- Enter the captcha and all other information and press submit button

- Information will show on the screen

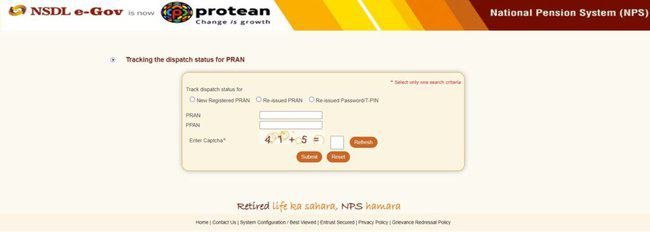

Procedure To Track PRAN Card status

- You should open the official website of the NSDL e-Gov portal

- From the home page go to the important links

- Look for the “Track PRAN Card status” option

- A new page will open choose any of the following

- New Registered PRAN

- Re-issued PRAN

- Re-issued Password/T-PIN

- Enter the PRAN and PPAN number and captcha code

- Press submit button and status will show on the screen

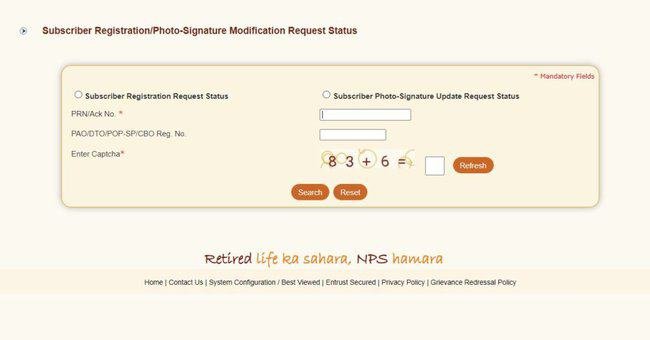

Track PRAN Application status

- You should open the official website of the NSDL e-Gov portal

- From the home page go to the important links

- Look for the “Track PRAN Application status” option

- A new page will open choose any of the following

- Subscriber Registration Request Status

- Subscriber Photo-Signature Update Request Status

- Enter the following details

- PRN/Ack No.

- PAO/DTO/POP-SP/CBO Reg. No.

- Enter Captcha

- Press the search button and information will show on the screen

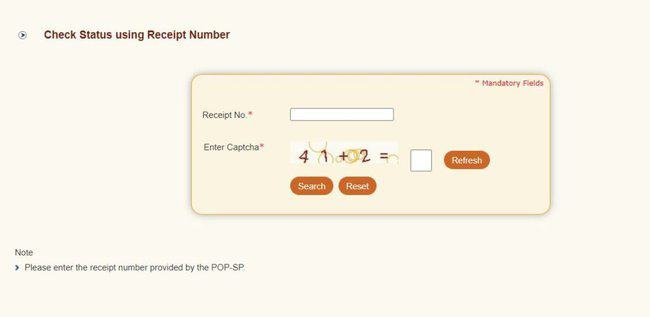

Registration And Contribution Status

- You should open the official website of the NSDL e-Gov portal

- From the home page go to the important links

- Look for the “Registration and Contribution status” option

- A new page will open, enter the receipt number and captcha code

- Press the search button and information will show on the screen

Find Nearest Trustee Bank Account

- You should open the official website of the NSDL e-Gov portal

- From the home page go to the important links

- Look for the “Find Nearest Trustee Bank Account” option

- Click it and the further option “click here to download” will show

- Click on it and the file will start downloading

Procedure To Find nearest NL-CC

- You should open the official website of the NSDL e-Gov portal

- From the home page go to the important links

- Look for the “Find nearest NL-CC” option

- Click it and the further option “click here to download” will show

- Click on it and the file will start downloading

Find your nearest CRA-FC

- You should open the official website of the NSDL e-Gov portal

- From the home page go to the important links

- Look for the “Find your nearest CRA-FC” option

- A new page will open, select city, and press the go button

- The List will appear on the screen

Helpline

- Toll-Free Number- 022 2499 3499