Looking for information related to the Mudra Yojana? Desire to get detailed information? If yes then you are on the right page. Here we are going to provide detailed information including eligibility criteria, interest rate, benefits, and much other important information. The scheme was started by the Prime Minister of India Mr. Narendra Modi in the year 2015. Under this scheme, the government is helping citizens who wish to do business by providing them loans up to Rs. 1000000. If you would also like to get benefits of the scheme then apply for the Yojana by following a few easy steps. You will get step-by-step instructions along with other significant details related to the yojana from further sections of this article.

What is Pradhan Mantri Mudra Yojana?

Mudra Yojana is a central government initiative launched on 8th April 2015. This initiative has been started by the central government to provide loans to help a citizen who wishes to do business. Noncorporate, non-farm small/ micro enterprises will get a loan of up to rupees 10 lakh under this scheme. The loan is given by commercial banks, RRBs, small finance banks, MFIs, and NBFCs. If you are interested in grabbing detailed information about the Yojana then you should read this article very carefully till the end point.

Key Highlights Of Mudra Yojana

- Article about: Mudra Yojana

- Launched by: Prime Minister Narendra Modi, Government Of India

- Launched in: 2015

- Launch on: April 8

- Launch for: citizen

- Benefits: loan up to 10 lakh

- Mode of application: online

- Official website: www.mudra.org.in

Pradhan Mantri Kaushal Vikas Yojana

Achievements Under PMMY Since Inception

| Financial Year | No. Of PMMY Loans Sanctioned | Amount Sanctioned | Amount Disbursed |

| 2015-2016 | 34880924 | 137449.27 Cr. | 132954.73 Cr. |

| 2016-2017 | 39701047 | 180528.54 Cr. | 175312.13 Cr. |

| 2017-2018 | 48130593 | 253677.10 Cr. | 246437.40 Cr. |

| 2018-2019 | 59870318 | 321722.79 Cr. | 311811.38 Cr. |

| 2019-2020 | 62247606 | 337495.53 Cr. | 329715.03 Cr. |

| 2020-2021 | 50735046 | 321759.25 Cr. | 311754.47 Cr. |

| 2021-2022 | 53795526 | 339110.35 Cr. | 331402.20 Cr. |

| 2022-2023 (till 08/07/2022) | 10036013 | 73199.89 Cr. | 68879.37 Cr. |

Purpose of Mudra Yojana

The motive of prime minister Narendra Modi behind starting Mudra Yojana is to provide financial help to the citizens in establishing their own Non-corporate, non-farm small/ micro enterprises. The scheme has been started to make the people self-reliant and empowered.

Benefit/ Features of Mudra Yojana

- Mudra Yojana has been launched by prime minister Narendra Modi

- It is beneficial for the citizen who wishes to start their business or already have small enterprises

- Beneficiaries can avail of up to 10 lakhs under this scheme

- The rate of interest given to the applicants will be as per the RBI guidelines you should from time to time.

- Having a pan card is not compulsory to get a mudra loan

- Beneficiaries need not submit any cultural or security to avail of the loan

- The repayment period of a loan can be extended up to 7 years

Type Of Loan

| Type Of Loan | Loan Amount |

| Shishu | Up to Rs.50,000 |

| Kishor | Rs.50,000 to Rs.5 lakh |

| Tarun | Rs.5 lakh to Rs.10 lakh |

Loan Provider

- Regional rural banks

- Microfinance institutions

- Commercial banks

- Small Finance banks

- Non-banking financial corporations

About Mudra Card

A Mudra card is a card by which borrowers can avail of credit in a hassle-free and flexible manner. Mudra cards act as the debit card also. Those who have Mudra cards can withdraw cash from ATMs or make purchases using POS machines or business correspondence. The borrower can repay the amount as and when surplus cash is available. If you pay the amount earlier then you will get a reduction in interest cost.

Type Of Businesses

An applicant who has the plan to do business of any of the following kinds can apply for a mudra loan

- Business vendors

- Shopkeepers

- Textile sector

- CNG Tempo/ Taxi

- Manufacturing units

- Processing units

- Trading Company

- Service sector

Eligibility Criteria

All citizens of India who meet the eligibility conditions specified below can apply for the mudra loan

- The applicant should be an Indian citizen

- Applicant must desire to do business for non-farming income-generating activities such as manufacturing processing trading or service sector

- The applicant has to fulfill the terms and conditions of lending agency from there he or she is going to take a loan

Documents

- Aadhar card

- Address proof

- Mobile number

- Email id

- Passport size photograph

- Other significant documents

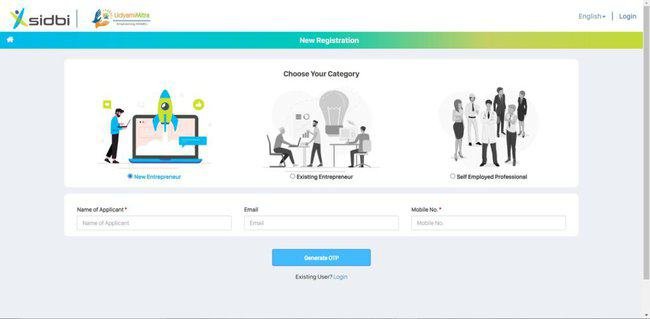

Procedure To Apply Online For Mudra Scheme

To get the benefits of the scheme you can apply online mode by following the below mention steps or visiting the lending institutions mentioned above.

- To apply for the scheme, you have to visit the official website of Mudra

- On the homepage of the portal, you will get the apply link or directly click here

- From the open page, you have to go to the mudra loan and click on apply now option

- This will open the registration page on the screen from where you have to select any of the following

- New entrepreneur

- Existing entrepreneur

- Self-employed professional

- Now you have to enter your name email ID and mobile number

- Press generate OTP option and you will receive an SMS and email along with the OTP

- Enter the OTP in the given space and click proceed option

- Follow the screen and complete the application form that appears on the computer screen

- Complete the application form and upload all the significant documents

- Submit the application form by pressing submit button after review

- Remember to keep a printout of the field application for further use if required

Download Mudra Application Form

You can get the application form from the lending institutions or by following the below mentioned steps

- First of all, you have to visit the official website of the Mudra

- From the home page of the portal, you have to go to the Shishu or Kishore, or Tarun option available at the end

- Click the link and a new page will open on the computer screen

- Now you have to click on the download button given in front of the common loan application form for Ford Kishore and Tarun or the application form for Shishu

- As you click the application form will start downloading on your device

- You can take a printout of the form and fill in the details on it

- Submit the field applied to the lending institution along with the necessary documents

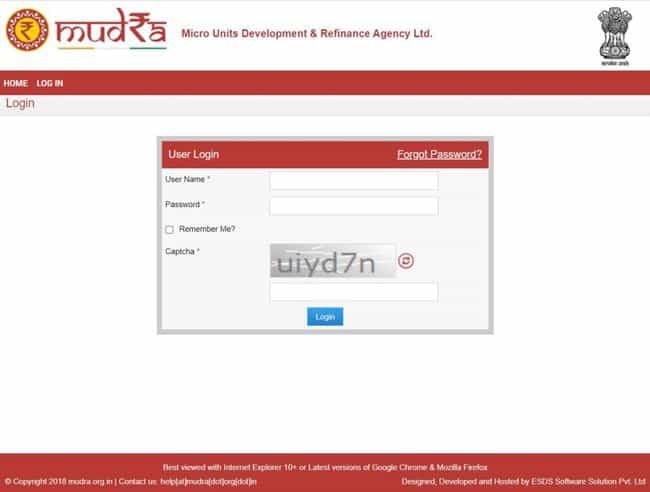

Login Procedure For PMMY Portal

- To log in you have to open the official website of the mudra

- From the open page of the portal, you have to click on login for PMMY portal option available in the top right side

- Login page will appear on the computer screen where you have to enter the login details as asked

- User Name,

- Password

- Capture Code as shown on the screen

- Click the Login button and the user dashboard will appear on the screen

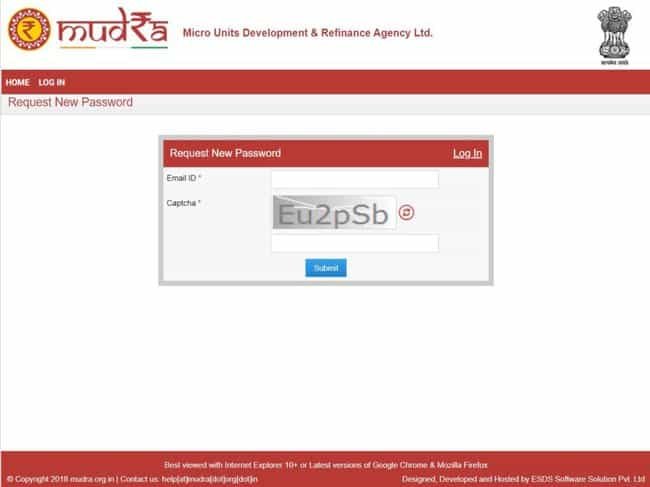

Recover Password

In case you forgot your password to login the PMMY Portal then you have to follow the below-mentioned steps

- To recover your password, you have to open the official website of the mudra

- From open page of the portal, you have to click on login for PMMY portal option available in the top right side

- Login page will appear on the computer screen where you have to choose forgot password option

- A new page will open on the screen, now you need to enter your email id and captcha shown on the screen

- Press submit button and you will receive an email along with the code

- Enter the code in the given space and press verify button

- Create a new password, enter the new password, confirm new password and submit it

Important Links

- Official website

- Download Shishu or Kishore or Tarun Application Form

- Checklist for Shishu Application

Contact Details

| National Toll-Free Number | 1800 180 1111/ 1800 11 0001 |

| State Toll-Free Number | |

| Maharashtra | 18001022636 |

| Chandigarh | 18001804383 |

| Andaman and Nicobar | 18003454545 |

| Arunachal Pradesh | 18003453988 |

| A state in Eastern India | 18003456195 |

| Andra Pradesh | 18004251525 |

| Assam | 18003453988 |

| Daman and Diu | 18002338944 |

| Dadra Nagar Haveli | 18002338944 |

| Gujarat | 18002338944 |

| Goa | 18002333202 |

| Himachal Pradesh | 18001802222 |

| Haryana | 18001802222 |

| Jharkhand | 18003456576 |

| Jammu and Kashmir | 18001807087 |

| Kerala | 180042511222 |

| Karnataka | 180042597777 |

| Lakshadweep | 4842369090 |

| Meghalaya | 18003453988 |

| Manipur | 18003453988 |

| Mizoram | 18003453988 |

| Chhattisgarh | 18002334358 |

| Madhya Pradesh | 18002334035 |

| Nagaland | 18003453988 |

| NCT of Delhi | 18001800124 |

| Odisha | 18003456551 |

| Punjab | 18001802222 |

| Puducherry | 18004250016 |

| Rajasthan | 18001806546 |

| Sikkim | 18004251646 |

| Tripura | 18003453344 |

| Tamil Nadu | 18004251646 |

| Telangana | 18004258933 |

| Uttarakhand | 18001804167 |

| Uttar Pradesh | 18001027788 |

| West Bengal | 18003453344 |

Grievance Officers

If you have any grievance related to the Mudra Yojana then you may contact the Grievance Officer on below-given contact details

| Customer Care Center | Address – Swavalamban Kendra, Plot No. C11, G Block, Bandra Kurla Complex, Bandra East, Mumbai – 400051, Maharashtra Telephone- 022-67221465 Email- help@mudra.org.in |

| Grievance Redressal Officer | Name – Shri Rajesh Kumar Email – rkumar@mudra.org.in |

| Chief Grievance Redressal Officer | Name – Mr. Amitabh Mishra Email – amitabh@mudra.org.in |

| Timings – Monday to Friday (10:00 AM to 6:00 PM) |