A lending programme called Pradhan Mantri Mudra Yojana (PMMY) was established by the central government to offer small and micro businesses that are not corporations or farmers loans of up to Rs. 10 lakh. Under the PMMY Scheme, these loans are categorised as Mudra loans. Commercial banks, RRBs, small finance banks, MFIs, and NBFCs offer these loans. Under the three categories of Sishu, Kishor, and Tarun of the PM Mudra Yojana, borrowers may apply for business loans ranging from Rs. 50,000 to Rs. 10 lakh. The list of shortlisted lending institutions that are providing Mudra Loans under the flagship PMMY Scheme will be discussed in this article. Check out the Mudra Loan Bank List 2025 specific details, including its goals, benefits, eligibility requirements, application procedures, list of participating banks, and more.

About Mudra Loan Bank List 2025

Three loan options are provided by PMMY: “Shishu,” “Kishore,” and “Tarun,” each depending on the micro-stage unit’s of development and financial needs. Companies can borrow up to Rs. 10 lakhs through PMMY’s simple finance initiatives to cover their operating expenses and capital requirements. These loans go by the name of Mudra Loan Bank List. The Pradhan Mantri Yojana was launched to support the expansion and success of small companies. This programme allows businesses in both the for-profit and nonprofit sectors to apply for loans, with a maximum credit sum of Rs. 10 lakh available to help them launch their venture. Under this plan, the MUDRA, a SIDBI subsidiary, assists lenders to non-corporate, non-farm small/microenterprises through supporting intermediaries including Commercial Banks, RRBs, Small Finance Banks, MFIs, and NBFCs.

Also Check: Mudra Yojana

Key Highlights of Mudra Loan Bank List

| Launched By | PM Narendra Modi |

| Name of Post | Mudra Loan Bank List 2025 |

| Objective | Motor vehicle loans |

| Benefits | Maximum loan amount: Rs. 10 lakhs |

| Eligibility Criteria | Individuals from India who have business plans |

| Year | 2025 |

| Official Website | Mudra Bank List |

The objective of Mudra Loan Bank List

MUDRA loans can be utilized for several things, including generating income and new jobs. The most frequent justifications for taking out Mudra loans are as follows:

- Applying for a business loan is open to shopkeepers, traders, vendors, and other service-based organizations.

- Motor vehicle loans

- People who operate in agri-allied non-farm income-generating enterprises like poultry farming, beekeeping, pisciculture, etc. are eligible for Mudra Loans.

- Equipment financing for small businesses

- Anyone who uses tractors, tillers, or two-wheelers for business purposes is eligible for a Mudra Loan.

- It is possible to obtain a working capital loan using MUDRA cards.

Benefits and Features of Mudra Loan Bank List

The following list includes some of the program’s main advantages and features:

- Loans without security

- The maximum loan amount is Rs. 10 lakhs.

- The Credit Guarantee Schemes of the Government of India cover the debt.

- Options include term loans, working capital loans, and overdraft facilities.

- Processing costs are significantly cheaper, and interest rates are also low.

- All non-farm firms, or small or micro businesses that make money, are eligible for Mudra loans.

- Mudra loans with lower interest rates are also available to people who fall under the SC/ST category.

- Loans with lower APRs for female business owners

- Financial and banking services can be found both in urban and rural areas.

- Start-ups and micro-small businesses are eligible for financial assistance.

- There are small company loans accessible with affordable interest rates.

- Food sellers, shop owners, and other small business owners can all profit from this initiative.

- For those who lack access to basic banking services, this initiative offers cash aid.

- The government takes on the borrower’s credit guarantee, which entails that it will bear the loss if the borrower is unable to pay back the loan.

- The repayment period under the plan may extend up to seven years.

- People who seek to make money through micro-enterprise operations can use the Micro Credit Scheme.

- Women borrowers are qualified for loans with reduced interest rates.

- There are other refinancing options offered by accredited lenders.

Products Related to the Mudra Scheme

There are three types of Pradhan Mantri Mudra Loans:

- Shishu Yojana: This type of Mudra loan is appropriate for micro- and small-business owners. Under this programme, one may apply for up to 50,000 in loans. Shishu loans are available to business owners who need a small amount of funding to launch their enterprise. Applicants must provide their business plan for their loan application to be granted.

- Tarun Yojana: Any small business owner who wants to grow their company is eligible to apply for a loan through this programme. Borrowers are eligible to apply for loans up to Rs. 10 lakh.

- Kishor Yojana: This category is for business owners who have already started a company and want to expand it into a successful enterprise. Loan applications for amounts ranging from 50,000 to 5 lakh rupees are accepted. To be eligible for a loan, borrowers must submit an application form together with documents attesting to the current state of their firm.

The Interest Rate on a MUDRA Loan

The person’s profile determines the interest rate for the Mudra loan. A number of banks in the public and commercial sectors offer MUDRA loans. The final interest rate at which a loan is granted to an applicant is decided by the lender, and all lenders must go by a set of rules. After carefully analysing the applicant’s business requirements, this is done.

The applicants will need to provide a few key papers when completing the Pradhan Mantri Mudra Loan Yojana application; be sure to have them on available. The following documents are necessary for the Pradhan Mantri Mudra Loan Yojana 2024:

- Properly completing the application form in accordance with the loan category

- 2 photos in passport size of the applicant

- Any legitimate identity document, such as an Aadhaar card, a passport, a driver’s licence, a PAN card, a voter ID card, etc.

- Any acceptable address proof, such as a voter ID card, a passport, a phone bill, an Aadhaar card, or an electricity bill.

- Proof of any special status, such as SC, ST, OBC, minority status, etc.

- A six-month bank statement

- Business address and, if necessary, tenure documentation

Important Dates

It has been extended until March 31, 2022, to submit claims under the 2% interest subvention scheme for shashi loans.

Eligibility Criteria

Indian nationals who have business ambitions for the service industry, commerce, or industrial operations and need funding of up to Rs. 10 lakh may apply for Mudra loans. Banks from both the public and commercial sectors, as well as small finance banks (SFBs) and micro financial institutions, also provide it (MFIs). To be eligible, applicants for the Pradhan Mantri Mudra Loan Yojana 2024 must meet the following requirements:

- Minimum age- 18 years

- There isn’t a need for third-party security or collateral.

- Maximum age- 65 years

- Who may apply for a Mudra Loan- Both new and existing units may apply for loans.

- Public sector banks, microfinance institutions, private sector banks, and regional rural banks are among the organisations that can provide Mudra loans.

Also Check: PM Jan Dhan Yojana

Pradhan Mantri Mudra Loan Yojana 2024 Application Procedures

The steps for applying for the Pradhan Mantri Mudra Loan Yojana 2024 are as follows:

- First, obtain the application form from the Pradhan Mantri Mudra Loan Yojana official website or go to the nearby commercial or private bank.

- Fill out the application form after receiving it with all the necessary information, such as your name, phone number, address, Aadhaar information, etc.

- Then, include all necessary documents, such as identity and address proofs, balance sheets, firm addresses, IT returns, and information about other machines, in the application form.

- To make sure there are no errors, examine and double-check the application form now.

- Send the application to the appropriate department.

- Finish all the procedures and formalities with the bank at this point.

- Following that, the relevant banks will verify all of your paperwork.

- The loan will finally be credited to the applicant’s account following all verifications.

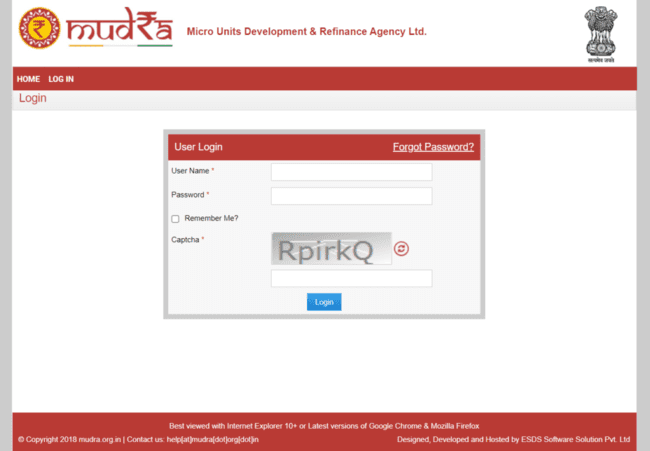

Procedure for Login to PMMY Portal

- To begin with, visit the Pradhan Mantri Mudra Loan Yojana official website.

- The website’s home page will appear on the screen.

- Go to the PMMY portal login link now from the homepage.

- The screen will change to a new page.

- In the application form, provide your username and password for logging in.

- Enter the captcha code that appears on the screen now.

- After that, select the “login” link.

Loans Made by Banks and NBFCs Under the PM Mudra Yojana

The financial institutions listed below provide MUDRA Loans in accordance with RBI instructions:

Public Sector Banks

- Central Bank of India

- Bank of Baroda

- Bank of India

- State Bank of India

- Bank of Maharashtra

- Canara Bank

- Corporation Bank

Private Sector Banks

- HDFC Bank Ltd.

- City Union Bank Ltd.

- Axis Bank Ltd.

- Federal Bank Ltd.

- Catholic Syrian Bank Ltd.

- DCB Bank Ltd.

Regional Rural Banks

- Deccan Grameena Bank

- Andhra Pragathi Grameena Bank

- Chaitanya Godavari Grameena Bank

- Madhya Bihar Gramin Bank

- Saptagiri Grameena Bank

- Bihar Gramin Bank

Co-operative Banks

- Gujarat State Co-op Bank Ltd

- Mehsana Urban Co-op Bank

- Rajkot Nagarik Sahakari Bank

- Kalupur Commercial Co-op Bank

MFI List Offering Mudra Loan

- Fusion MicroFinance P. Ltd.

- S V Creditline Pvt. Ltd.

- Madura Micro Finance Ltd.

- Margdarshak Financial Services Ltd.

- ESAF Micro Finance & Investments P. Ltd.

- Ujjivan Financial Services P. Ltd.

NBFC List

- Shriram Transport Finance Co. Ltd.

- Fullerton India Credit Co. Ltd.

- Reliance Capital Ltd.

- SREI Equipment Finance Ltd.

- Magma Fincorp Ltd.

Contact Details

Please call the toll-free lines listed below if you have any questions or complaints about the Pradhan Mantri Mudra Loan Yojana 2025 or would like more information:

- 1800-180-1111

- 1800-11-0001