The Municipal Corporation of Delhi (MCD) has introduced a new house tax waiver scheme to help homeowners and small businesses. Under this scheme, if people pay their house tax for the 2024-25 financial year on time, all their past dues will be cleared. This will reduce financial stress for many families. MCD Mayor Mahesh Khichi said that this step will make tax collection fair and transparent. Experts believe it will also prevent future tax issues. For example, families in areas like Laxmi Nagar and Patel Nagar will no longer have to pay house tax, making life easier for them. The scheme is expected to be approved soon.

About MCD House Tax Waiver Scheme

The MCD House Tax Waiver Scheme is a big help for many people in Delhi. Families living in small homes, like in Laxmi Nagar and Patel Nagar, will not have to pay house tax anymore, which will reduce their financial burden. People with bigger houses in places like South Extension and Vasant Kunj will get a 50% tax cut, making it easier for them to pay. Small shop owners in busy markets like Chandni Chowk and Karol Bagh will also benefit because their commercial properties now qualify for tax relief. Housing societies in areas like Mayur Vihar and Janakpuri, which never got any exemption before, will now receive a 25% tax waiver. This scheme will save money for many people and make the tax system more fair and transparent, reducing problems and corruption.

Key Highlights of MCD House Tax Waiver Scheme

| Name of the Scheme | MCD House Tax Waiver Scheme |

| Launched by | MCD Mayor Mahesh Khichi and others |

| Objective | To reduce house tax burden |

| Full exemption | Homes up to 100 sq. yards |

| 50% tax waiver | Homes between 100 – 500 sq. yards |

| 25% rebate | Given to 1,300 housing societies |

| Help for shop owners | Tax relief in special areas |

| Clearing past dues | Homeowners can pay only current tax |

| More transparency | Reduces corruption and tax disputes |

| Application Process | Online & Offline |

| Official Website | https://mcdonline.nic.in/portal |

Motive of MCD House Tax Waiver Scheme

The MCD House Tax Waiver Scheme aims to help people in many ways:

- Families in small homes like Laxmi Nagar and Patel Nagar won’t have to pay house tax, giving them financial relief.

- People with big houses in areas like South Extension and Vasant Kunj will get a 50% tax cut, making payments easier.

- Small shop owners in busy markets like Chandni Chowk and Karol Bagh will also get tax relief, helping their businesses grow.

- Housing societies in places like Mayur Vihar and Janakpuri will get a 25% tax waiver, making life easier for many residents.

Eligibility Criteria

The MCD House Tax Waiver Scheme has set new rules for eligibility:

- Homes up to 100 square yards will not have to pay any house tax.

- Houses between 100 and 500 square yards will get a 50% tax discount.

- Around 1,300 housing societies will now get a 25% tax reduction.

- The MCD is also working to make 12,000 more workers permanent.

Benefits of MCD House Tax Waiver Scheme

The MCD House Tax Waiver Scheme brings many benefits to people in Delhi:

- Homes and small shops up to 100 square yards will not have to pay any house tax from the next financial year.

- Houses between 100 and 500 square yards will get a 50% tax discount, making payments easier.

- Around 1,300 housing societies will now receive a 25% tax rebate, helping many families.

- The scheme makes tax collection simpler and reduces financial stress for homeowners.

Required Documents

The MCD House Tax Waiver Scheme requires some important documents:

- Property tax bill

- Identity proof

- Receipt of latest property tax payment

Salient Features

The MCD House Tax Waiver Scheme has many important features to help people:

- Small shop owners in special areas will also get tax relief.

- It helps families and businesses save money on tax payments.

- The scheme makes tax collection easier and more transparent.

- It reduces the chances of tax-related disputes and confusion.

- Many homeowners can now clear old tax dues without extra charges.

- The plan will make the tax system fairer for everyone.

- It helps both small and big property owners in Delhi.

How to Fill MCD House Tax Online?

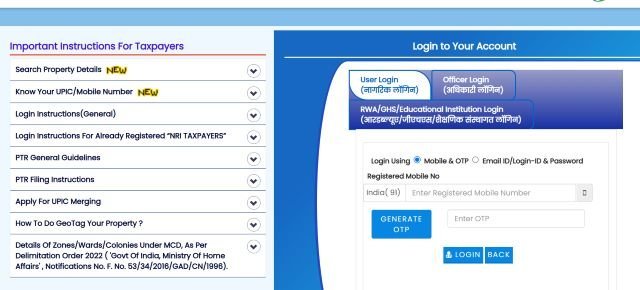

Step 1: Visit the MCD Online Portal.

Step 2: Click on the “Pay Property Tax” option on the home page.

Step 3: Enter your registered mobile number and click on “Generate OTP”.

Step 4: Submit the OTP and click on “Login”. If you are a new user, click on “New User Click Here for SignUp / Registration”.

Step 5: Your property details like UPIC, property type, owner type, name, and address will be displayed.

Step 6: Click on the “Actions” button and then on “Pay Tax”.

Step 7: Select the “Financial Year” for which tax has to be paid and click on “Submit”.

Step 8: A pop-up will ask if there are any changes in property details. Click on “Yes” to edit or “No” to proceed.

Step 9: You will see the tax details and rebate percentage. Verify and click on “Download PDF”.

Step 10: Click on “Pay Tax”, choose payment mode (credit card, debit card, or net banking), and click “Pay Now”.

Step 11: Once payment is done, the status will show “Success”.

Step 12: Download the receipt for future reference.

Offline Process

Property owners can pay house tax offline in Delhi easily:

Step 1: Visit any ITZ cash counter nearby.

Step 2: There are 800 counters in different places in Delhi.

Step 3: Give your property details to the staff.

Step 4: Pay the house tax amount at the counter.

Step 5: Get an instant MCD property tax receipt.

Step 6: Check the receipt for your property tax ID.

Step 7: Keep the receipt safe for future payments.

Helpline Number

- Address: Dr. S.P.M. Civic Centre, Minto Rd, SKD Basti, Press Enclave, Ajmeri Gate, New Delhi, Delhi, 110002

- Mobile App: Unified Mobile App, MCD311 App

- Helpline Number (CCR): 155305

- Email ID: mcd-ithelpdesk[at]mcd[dot]nic[dot]in

FAQs

Who is eligible for the MCD House Tax Waiver Scheme?

Properties up to 100 square yards get full exemption. Homes between 100-500 square yards get a 50% waiver. Housing societies receive a 25% rebate.

How can I pay my MCD house tax offline?

Visit any of the 800 ITZ cash counters in Delhi. Pay the tax and collect the receipt with your Property Tax ID.

Is there a mobile app for property tax payments?

Yes, you can use the Unified Mobile App or MCD311 App.

What documents are needed for property tax payment?

Property tax bill, identity proof, and latest payment receipt.