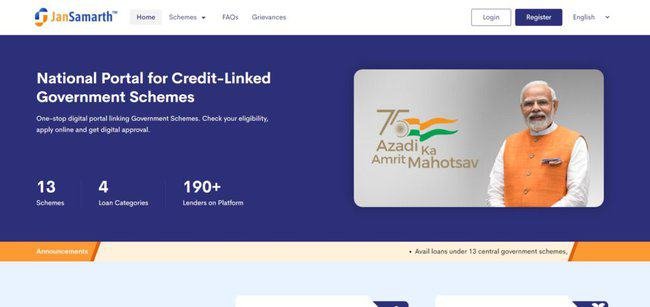

The government has decided to launch Jan Samarth Portal, a one-stop portal, for all credit link subsidy programmes. The Government of India’s JanSamarth Portal is a cutting-edge digital platform that unites thirteen Credit Linked Government Schemes on a single platform for the benefit of all beneficiaries and associated parties. Citizens will be able to learn more about all of the government’s credit link subsidy programmes on this portal. The scheme’s key details will be covered in detail in this article. You will learn how to register for and log into the Jan Samarth Portal 2025 online. Additionally, you will learn about numerous credit link subsidy programmes. So let’s read this article and gather all the pertinent details about the gateway.

About Jan Samarth Portal 2025

Government of India initiative called JanSamarth Portal. The Jan Samarth Portal makes use of cutting-edge technology and clever analytics to offer beneficiaries simple assistance for determining subsidy eligibility, and an auto recommendation engine suggests the best-suited schemes per the beneficiary’s requirements and credentials. Modern technologies use digital verifications to automate the entire lending process, making it quick, easy, and hassle-free. On June 6, 2022, Prime Minister Narendra Modi introduced the Jan Samarth Portal. This website serves as a central hub for all of the government’s credit link programmes. The beneficiaries and lenders will be connected directly through this platform. This portal will feature some integration platforms, which will serve as the foundation for digital access to authenticate data and lessen the burden on both beneficiaries and member lending institutions.

Also Check: Meri Pehchan Portal

Key Highlights of Portal

| Launched By | Government of India |

| Name of Portal | Jan Samarth Portal 2025 |

| Objective | To encourage inclusive growth and sectoral development |

| Benefits | A single entry point for all of the government’s credit link programmes |

| Eligibility Criteria | Residents of India |

| Year | 2025 |

| Official Website | Click Here |

Objective of Jan Samarth Portal

The fundamental goal of Jan Samarth Portal is to give all credit-linked schemes a single platform. Beneficiaries are no longer required to visit several websites to obtain information about various programmes. Time and money will be greatly reduced, and the system will become more transparent as a result. There will be no hassles or complicated steps in the lending procedure. Digital verifications will be made using this platform, simplifying the loan procedure. Through this portal, beneficiaries can also verify their eligibility and receive auto-recommended offers depending on the appropriate programmes.

Benefits and Features Jan Samarth Portal

- On June 6, 2022, Indian Prime Minister Narendra Modi debuted the Jan Samarth Portal.

- This website serves as a central hub for all of the government’s credit link programmes.

- The beneficiaries and lenders will be connected directly through this platform.

- The major goal of the introduction of this portal is to support the development and growth of diverse sectors that are inclusive by assisting them in obtaining the appropriate government benefits through straightforward digital procedures.

- This webpage will completely cover all of the government’s credit-related programmes.

- 13 credit-linked government programmes will initially be available on this portal.

- The entire financing process will be made simple, quick, and hassle-free on this portal.

- The backbone of digital access to authenticate data will be provided by this portal’s different integration platforms, which will also make it easier for members of the lending institution and beneficiaries to access the information.

Scheme Available Under Jan Samarth Portal

- Educational Loan

- Central sector interest subsidy

- Padho Pardesh

- Dr Ambedkar’s Central sector scheme

- Agri infrastructure loan

- Agri Clinic and Agribusiness Centre scheme

- Agriculture marketing infrastructure

- Agriculture infrastructure fund

- Business Activity Loan

- Prime Minister Employment generation program

- Weaver Mudra scheme

- Pradhanmantri mudra Yojana

- Pradhanmantri street vendor Atma nirbhar Nidhi scheme

- Self-employment scheme for rehabilitation of manual scavengers

- Stand up India scheme

- Livelihood loan

- Dindayal antyoday Yojana-National Rural Livelihood mission

Banks Partner List Of Jan Samarth Portal

- Kotak Mahindra Bank

- National bank for Agriculture and Rural Development

- Indian Bank

- Indian overseas Bank

- Punjab and Sind Bank

- UCO Bank

- Union Bank

- Bank of India

- Central Bank of India

- Bank of Maharashtra

- ICICI Bank

- Axis Bank

- IDBI Bank

- HDFC Bank

- State Bank of India

- Punjab National Bank

- Canara Bank

- Bank of Baroda

- SIDBI

Stakeholders of the Jan Samarth Portal

- Financial institutions and lenders

- Ministries of the federal and state government

- Nodal agencies

- Applicants

- Facilitators

Eligibility Criteria

The applicant must reside in India permanently.

Documents Required

- Aadhaar ID

- Voter identification

- PAN card

- Bank statement

- A passport-sized photo

- Your phone number, etc.

Also Check: MAARG Portal

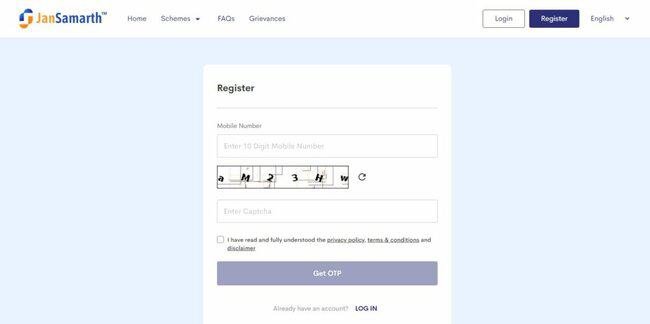

Procedure To Register Under Jan Samarth Portal 2025

- Applicants first need to visit the Jan Samarth portal’s official website to get started with the registration process.

- Before you will be the home page.

- You must click the Register link only on the home page.

- Before you will be a new page.

- You must input your captcha and mobile number on stage.

- You then need to select “obtain OTP”

- You must now type OTP into the OTP box.

- After that, you must select “submit.”

- You’ll see the registration form there.

- You must fill out this registration form with all the necessary information.

- You must now upload all necessary documents.

- After that, you must select “submit.”

- Following these steps will allow you to register on the Jan Samarth portal.

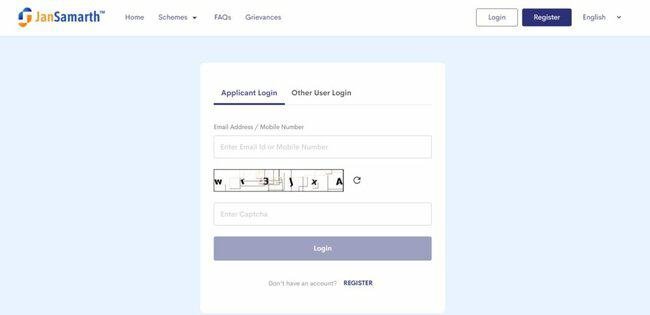

Steps for Login into the Jan Samarth Portal

- Applicants first need to go to the Jan Samarth portal’s official webpage.

- Before you will be the home page.

- On homepage you must now click the login button.

- Before you will be the Login form.

- You must provide your email address or mobile number as well as the captcha code in this form.

- You must then click the login button.

- You can log in to the portal by using this process.

Learn More About Different Schemes

- Applicants must visit to the Jan Samarth portal’s official webpage.

- Before you will be the home page.

- You need to select schemes from the homepage’s list of options.

- The following choices will be presented to you:

- Education loan

- Agricultural infrastructure loan

- loan for commercial activity

- Loan for a living

- All Schemes

- You must select the desired option by clicking.

- The next step is to choose the sub-schemes.

- The needed information will appear on your computer screen.

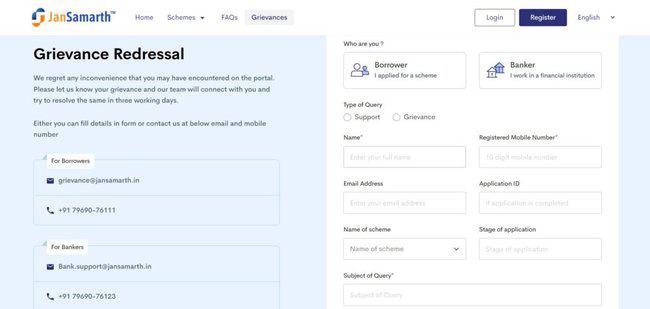

How to File a Grievance

- Applicants must visit the Jan Samarth portal’s official website.

- Before you will be the home page.

- On homepage, you have to select the complaint option.

- You’ll see the grievance form there.

- You must choose your category and query type.

- Following that, you must enter the following data:

- Name of scheme

- Stage of application

- Subject of query

- Query description

- Name

- Registered mobile number

- Email address

- Application ID

- Subsequently, you must upload the pertinent document.

- You must now select “submit.”

- This process will allow you to file a grievance.

Contact Details

- For Borrower

- Email id: mailCustomer.support@jansamarth.in

- phone+91 79690-76111

- For Bank & Others

- Email id: mailBank.support@jansamarth.in

- phone+91 79690-76123

FAQ Related to JanSamarth Portal

JanSamarth portal is a one-stop platform which connects thirteen Credit Linked Government Schemes.

There have been four loan categories, and each loan category has a list of different plans.

You must first determine your eligibility for your desired loan category by responding to a few straightforward questions. Once you are found to be eligible under one of the schemes, you can choose to move on with an online application to gain digital approval.

The documentation requirements vary depending on the scheme. Aadhaar Number, Voter Id, PAN, Bank Statements, and other fundamental papers are needed in order to apply online through the Portal. Additionally, the candidate must fill out some basic information on the site.

Anybody may submit a loan application. You must first determine your eligibility for the relevant loan category, and if you are, you may submit an online loan application.

On the website, the applicant can view the status of their loan application. Log in with your registration credentials and select the “My Applications” page to view the progress of your applications.

SIR CENTRAL BANK NOT SHOW IN LOAN