The government has allocated Rs. 69,515 crore to the Pradhan Mantri Fasal Bima Yojana (PMFBY) to insure farmers’ crops against natural disasters until 2025-26. PMFBY supports farmers by compensating for crop losses, stabilizing incomes, promoting better farming methods, and encouraging loans for food security. Over eight years, it has paid Rs. 1.70 lakh crore in claims. Additionally, a Rs. 824.77 crore Fund for Innovation and Technology (FIAT) was created to boost research and technology for better claim processing and transparency in the scheme.

PM Fasal Bima Yojana Update

The government has extended the Pradhan Mantri Fasal Bima Yojana (PMFBY) with a Rs. 69,515 crore budgets until 2025-26. This crop insurance scheme protects farmers from financial losses due to natural calamities, ensuring income stability and promoting better farming practices. PMFBY has paid Rs. 1.70 lakh crore in claims over eight years. A new Rs. 824.77 crore Fund for Innovation and Technology (FIAT) supports advancements like remote sensing for yield estimation and automated weather monitoring, enhancing claim transparency and efficiency. These updates aim to strengthen agricultural resilience and support sustainable farming nationwide.

Objective of Fasal Bima Yojana

- Provide financial help to farmers for crop losses caused by natural disasters.

- Ensure farmers’ income remains stable even during tough times.

- Encourage the use of better farming practices and modern techniques.

- Promote credit flow to farmers for food security and crop diversification.

- Protect farmers from risks like droughts, floods, and other unforeseen events.

- Use technology to make claim settlements faster and more transparent.

- Support sustainable agriculture and reduce the financial burden on farmers.

Key Highlights of Fasal Bima Yojana

| Name of the scheme | Pradhan Mantri Fasal Bima Yojana |

| Purpose | Protect farmers from crop losses due to natural disasters |

| Budget | Rs. 69,515 crore allocated until 2025-26 |

| Claims Paid | Rs. 1.70 lakh crore paid to farmers over 8 years |

| Coverage | Insures crops against risks like drought, flood, hailstorm, and cyclones |

| Fund for Innovation | Rs. 824.77 crore FIAT to improve transparency and efficiency |

| Benefits | Stabilizes farmers’ income and promotes sustainable agriculture |

| Crops Covered | Includes food crops, oilseeds, and horticultural crops |

| Focus | Encourages credit flow and innovative farming practices |

| Mode of Application | Online |

| Official website | https://pmfby.gov.in/ |

Eligibility Criteria

- Farmers must be at least 18 years old.

- Grow notified crops in a notified area.

- Must have an insurable interest in the crops they cultivate.

- Valid land ownership documents are required.

- Farmers must not have received compensation for the same crop loss from another source.

- The scheme is optional for all farmers, including those with Crop Loans or Kisan Credit Cards (KCC).

Benefits of Fasal Bima Yojana

- Protects farmers from financial losses due to crop damage.

- Covers risks from natural disasters, pests, diseases, and post-harvest losses.

- Stabilizes farmers’ incomes and reduces financial stress.

- Encourages farmers to adopt better farming practices and technology.

- Promotes access to agricultural loans and credit.

- Supports food security and crop diversification efforts.

- Claims are processed quickly with the use of advanced technology.

- Helps farmers recover and continue farming after a loss.

Required Documents

- Proof of Identity (Aadhaar Card, Voter ID, etc.)

- Proof of Land Ownership

- Crop Details (Crops grown, area of cultivation)

- Bank Account Details (for claim settlement)

- Kisan Credit Card (KCC) or Crop Loan details (if applicable)

- Photographs of crops (if required)

- Aadhar-linked mobile number for communication

Salient Features

- Covers a wide range of risks like natural disasters, pests, and diseases.

- Provides financial support to farmers for crop loss or damage.

- Uses technology like remote sensing for faster and accurate claim settlements.

- Available for all farmers, including those with Crop Loans or Kisan Credit Cards.

- Premiums are affordable, and the government shares the cost with farmers.

- Claims are settled quickly to help farmers recover and continue farming.

- Provides coverage for both pre-harvest and post-harvest losses.

- Easy online application and claim process through the NCIP portal.

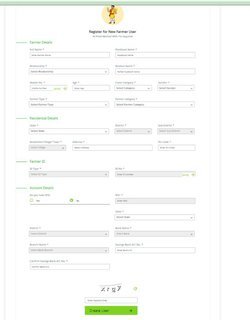

Application Process

Step 1. Visit the Official PMFBY Website.

Step 2. Create a farmer login account with your personal and farm details.

Step 3. Choose the crops you want to insure and select the coverage options.

Step 4. Submit the required documents, such as land ownership proof and identity details.

Step 5. Pay the premium, which may be partially subsidized by the government.

Step 6. After enrollment, receive a confirmation of coverage for your crops.

Step 7. In case of crop loss, file a claim using the portal, providing necessary details.

Step 8. Claims will be processed, and compensation will be transferred directly to your bank account.

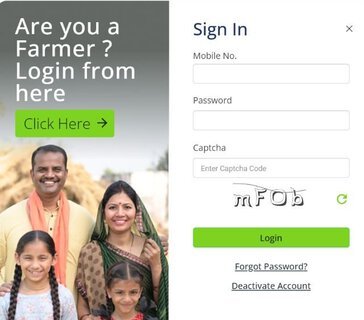

Login for Fasal Bima Yojana

Step 1. Visit the official website.

Step 2. Click on the “Farmer Login” option on the homepage.

Step 3. Enter your registered mobile number or Aadhaar number.

Step 4. Create a password or enter your existing login details if you already have an account.

Step 5. Complete the CAPTCHA to verify that you’re not a robot.

Step 6. Click “Login” to access your account.

Step 7. Once logged in, you can apply for coverage, track claims, or update your details.

Helpline Number

For information related to Pradhan Mantri Fasal Bima Yojana (PMFBY), you can call the following helpline numbers:

- 14447

- 1800-209-5959

- 1800-2-660-700

FAQs

Who is eligible for PMFBY?

Farmers growing notified crops in notified areas are eligible. The scheme is voluntary for all farmers, including those with Crop Loans or Kisan Credit Cards (KCC).

How can I apply for PMFBY?

You can apply online through the NCIP website by creating a farmer login account and submitting the required documents.

What crops are covered under PMFBY?

The scheme covers food crops, oilseeds, and commercial/horticultural crops.

Is the scheme mandatory?

The scheme is optional for all farmers, but those with Crop Loans or Kisan Credit Cards are automatically covered unless they opt out.

How do I check the status of my claim?

You can check the status of your claim by logging into your account on the NCIP website.

Who pays for the premium?

The premium is shared between the government and the farmers. The government pays a significant portion of the premium to reduce farmers’ burden.

How do I contact for support?

For assistance, you can call the helpline numbers: 14447, 1800-209-5959, or 1800-2-660-700.