If you are a permanent resident of the Karnataka state then you can apply for the E Swathu Karnataka. There are two main documents that are available in the online portal created by the Government of Karnataka state in the year 2021 so that there is a proper development related to the ownership details of the property situated in the rural areas of Karnataka. Check out the details related to form 9 and form 11 from the official website of the organisation. We will also share with you all the procedures to search for the property available on the official website. We will also share with you all the procedures to download forms 9 and 11.

E Swathu Karnataka

E Swathu Karnataka portal is a portal which is created in order to provide proper opportunities to the resident so that they can easily check the details related to the property tax that they need to pay and also the owner of the property that is present in the rural areas of the Karnataka States so that there is a transparency in the procedure of transferring property from one person to another. The owners will be able to download the details related to their property by visiting the official portal and filling out the application form available at the official website of the portal. There are two main forms that will be available on the official website and you can download both of the forms and apply for the ownership of your choice by visiting the official portal without any hardship in your way.

Also Check: Bhoomi Karnataka

Objective Of E Swathu Karnataka

The objective of the scheme is to provide proper opportunities to all the residents of the Karnataka state so that they can get the details related to the land records which are available in the Karnataka state and this will also prevent fraud activities that are going on in the real state and the property businesses in the Karnataka state. This will help the people to maintain their ownership and there will be physical property data available for each Gram Panchayat. Property facts will be available through the development of this scheme and it will make clear who owns the property in the rural areas so there are no fraudulent practices.

Types of Forms

There are two types of forms available on the official website of the organisation as mentioned below:-

- Form-9: It is a form that Gram Panchayats create for non-agricultural properties which fall under their jurisdiction. The Karnataka Panchayat Raj is responsible for issuing this document as per (Grama Panchayat Budgeting and Accounting) Rules, 2006 (Rule 28, Amendment Rules 2013). The form should be sanctioned under the Town and Country Planning Act by the government department concerned with the plan. Make sure that the tahsildar verifies your form and that its location within the gramathana of the village is confirmed via a sketch. The form is generally issued to Basava Vasati, Ambedkar, and Indira Awaas Yojana government housing schemes.

- Form-11: The Gram Panchayat has issued this form for non-agricultural land which falls under their jurisdiction. The jurisdiction should be as per Karnataka Panchayat Raj Rules, 2006 (Rule 30, Amendment Rules, 2013).

Also Read: SWAMITVA Yojana

Documents Required for Form 9

You will need the following documents according to the respective conditions to avail of form 9 from the E Swathu portal:

| Condition | Required Documents |

| The property falls under the Gramathana | Sketch of Gramathana. Property sketches should be surveyed and certified by the tehsildar. |

| If a property has to be converted. (If the property was in legal disputes) | Ownership document.Conversion order which is issued by the Revenue Department.Approval of the plan |

| Property is part of government schemes like Basava Vasati, Ambedkar, and Indira Awaas Yojana | Hakku Pathra and sanction order. |

| Other mandatory documents required for every condition | Applicants’ photograph identity proof address proof |

Uses of Form 9 and Form 11

Form-9 and Form-11 are necessary property-related forms. The following are the uses of both forms:-

- Form-9 and Form-11, available on E-Swathu online, are used for property tax collection.

- These documents are mandatory to pay property tax levied by Gram Panchayat.

- Mandatory for property registration, especially non-agricultural properties.

- Also, these documents will be required if you decide to sell off the property that falls in Gram Panchayat jurisdiction.

E Swathu Karnataka Create Form 9

If you want to create Form 9 then you will have to follow the simple procedure given below:-

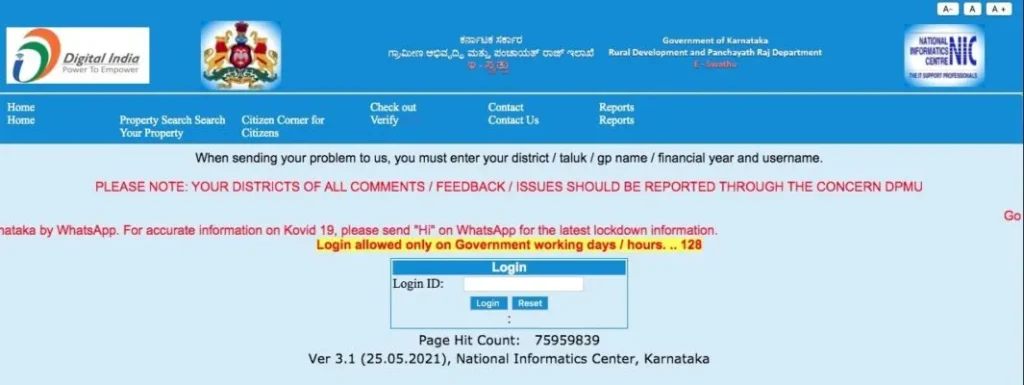

- You will first have to visit the official website of the Government of Karnataka by clicking on the link given here

- The home page will open on your screen.

- Enter your login ID in the appropriate field.

- In order to log into the web portal, you will need to use the fingerprint biometric input. At every tier of the login process, you will be required to provide biometric verification.

- Once you have successfully logged in, a menu will appear on the far left-hand side of the website. For the insertion of new property information, choose the second available option

- Enter all the data that is available in the fields that are provided, and then click on “Ulisu aasthi” at the bottom of the page.

- After you have saved the file, go to the previous step and choose the ‘Owner’ option.

- In this section, you are tasked with performing the following actions inside the many tabs that are accessible on the screen:

- Fill in the information about the owner(s).

- Please provide any documentation that may verify your ownership.

- Enter property details such as property’s Dimensions, GP coordinates, Rights, Liabilities, Documents Necessary, and Survey No., as well as any other information that is required.

- Now, click the Save button.

Create Form 11

If you want to create form 11 then you will have to follow the simple procedure given below:-

- You will first have to visit the official website of the Government of Karnataka by clicking on the link given here

- The home page will open on your screen.

- You will need to submit your Registration Details as well as your Electricity Details. When you save the entries, Forms 9 and 11 will automatically create for you.

- Select the application number that appears when you have finished saving your submission.

- To forward the application to the subsequent stage of official approval, choose the “karyadarshiya anumodanege sallisu” option from the menu on the far left, which is the fourth choice from the top.

- Entails selecting the home or business, making any necessary remarks, and then clicking the “Forward” button.

- The gram panchayat secretary will be able to view, via the use of their login, the forms that are waiting for verification them after they have been prepared and sent to the gram panchayat secretary, who is responsible for them. After confirming the application’s legitimacy, they will either forward it to the Panchayat Development Officer or send it back for further editing.

Search Property

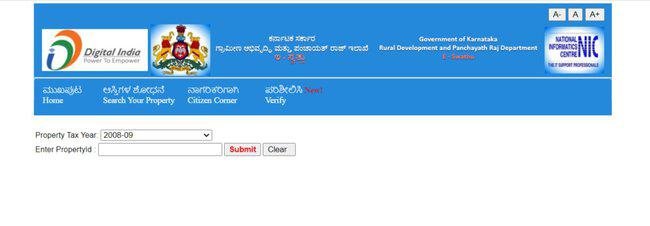

If you want to search your property then you will have to follow the simple procedure given below:-

- You will first have to visit the official website of the Government of Karnataka by clicking on the link given here

- The home page will open on your screen.

- You have to now click on the option called Search Your Property

- A new page will open on your screen where you enter details like District, Block, Gram Panchayat, Village, Property ID, Owner’s Name, and “Printed Forms” from the dropdown menus in each field.

- Click the “Search” button.

- The following details will display:

- Document Number, Property Code, ID of the Property Owner’s name, Name of the village and Asset number.

- To get the form, click on Document No. This is how you can get both Form-9 and Form-11.

- If you want to see other information, click on “All.”

- You will be able to see the Property details.

Download Reports

If you want to download important reports then you will have to follow the simple procedure given below:

- You will first have to visit the official website of the Government of Karnataka by clicking on the link given here

- The home page will open on your screen.

- You have to now click on the option called Reports

- A drop-down menu with the following options will open on your screen.

- Click on the option of your choice and a new page will open on your screen.

- Enter the specifications of your address and the report will display on your screen.

Tax Calculation

If you want to calculate tax then you will have to follow the simple procedure given below:-

- You will first have to visit the official website of the Government of Karnataka by clicking on the link given here

- The home page will open on your screen.

- You have to now click on the option called Verify

- A drop-down menu will open on your screen and you have to click on the option called Property Tax Calculator

- A new page will open on your screen.

- Enter your property ID and your tax will calculate.

Download App

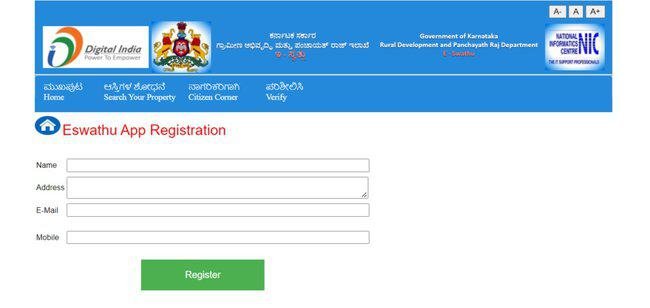

If you want to download the app then you will have to follow the simple procedure given below:-

- You will first have to visit the official website of the Government of Karnataka by clicking on the link given here

- The home page will open on your screen.

- You have to now click on the option called Verify

- A drop-down menu will open on your screen and you have to click on the option called Register And Download Eswathu App.

- A new page will open on your screen where you have to enter your details and click on register.

- The app will open on your screen which you can download successfully.

Contact Details

- Email ID: eswathuhelpdesk@gmail.com

- Phone number: 080-22032754