The Bihar state government has launched the Bihar Student Credit Card College List 2025. Are you also a student of Bihar State who wants to pursue higher education, but due to financial struggles, you cannot? Then worry not, the state government has introduced a new scheme for you. Under this initiative, the Bihar state government will provide a loan facility to the students and allow them to pursue wire education by getting low interest loan. Loan amount UP to INR 4 lakh will be given to the students to allow them to pursue higher education without any financial difficulties.

Objective of Student Credit Card

The main objective of launching the Bihar Student Credit Card Yojana is to allow the financial students to pursue higher education. The loan amount will be given to the students who have completed the class 12 examination and want to pursue higher education in the state. The loan will be at a very low interest rate, and subsidies will be given to female students and specially abled students. This initiative will make education easy for financial students and allow them to complete their undergraduate and postgraduate studies without any problem. Students can easily check the number of colleges that are available under the scheme by visiting the official website.

Key Highlights of Bihar Student Credit Card College List

| Key Highlights | Details |

| Name of the Scheme | Bihar Student Credit Card College List |

| Launched By | Bihar state government |

| Launch Date | 2025 |

| Announced By | Bihar state government |

| Purpose | Provide financial help |

| Beneficiaries | Students of Bihar |

| Target Beneficiaries | Students of Bihar who want to study for the education |

| Advantage | Iow interest loan of up to INR 4 lakh |

| Eligibility Criteria | Female students pursuing higher education |

| Required Documents | Aadhaar Card, Bank account |

| Application Process | Online |

| Official Website | https://www.7nishchay-yuvaupmission.bihar.gov.in/listofcollegedetail |

| Expected Benefits | Iow interest loan of up to INR 4 lakh |

| Contact Details | spmubscc@bihar.gov.in |

Eligibility Criteria

- The students must be permanent residents of Bihar State.

- The students must have completed their 12th class examination.

- The students must belong to a financially weak household.

Benefits of Credit Card

- With the help of the scheme, the students of Bihar State can pursue higher education easily without any difficulty.

- The students will get a loan amount of up to INR 4 lakh, allowing them to pursue undergraduate and postgraduate degrees easily.

- The interest on the loan amount will be very low, allowing students to easily repay the amount without any problem.

- Theories will provide a flexible repayment option, allowing students to repay the loan after completing their education.

Also Read: Mukhyamantri Pratigya Scheme

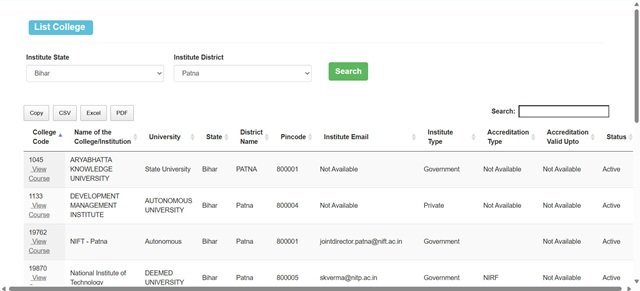

How to Search and Download Bihar Student Credit Card College List ?

- STEP 1: All the students who want to search the Search and Download Bihar Student Credit Card College List are requested to visit the official website.

- STEP 2: Once the students reach the homepage of the official website, they must locate and click on the option called “check list”.

- STEP 3: A new page will appear on your desktop screen. The students must enter their state and district name.

- STEP 4: After entering the details, the students can click on the option “Search” to complete their process.

Detail Mentioned Under List

- College Code

- Name of the College/Institution

- University

- State

- District Name

- Pincode

- Institute Email

- Institute Type

- Accreditation Type

- Accreditation Valid Up to

- Status

Contact Details

- Email: spmubscc@bihar.gov.in

FAQs

Who is eligible to avail the benefits of the scheme?

All the meritorious students of Bihar who want to pursue higher education are eligible to avail the benefits of the scheme.

What is the loan amount given under the scheme?

The loan amount of INR 4 lakh will be given under the scheme.

What is the main objective of launching the scheme?

The main objective of launching their scheme is to allow the students pursue higher education.