The government adopts a variety of pension plans to ensure financial security after retirement. Both workers in the organized and unorganized sectors get pensions through these programmes. The Assam pension programme was just recently introduced by the Assam government. Government employees will receive a pension through this programme. After completing up to 25 years of qualifying service, a pensioner is qualified to receive a superannuation pension. Six months after retirement, the pension documents must be presented. The Assam Pension Scheme 2025 is fully discussed in this article. By reading this post, you will learn how you can benefit from this scheme. Additionally, you will learn about its goals, advantages, characteristics, eligibility, needed paperwork, the application process, etc.

About Assam Pension Scheme 2025

To guarantee the financial stability of government employees after retirement, the Assam government introduced the Assam Pension Scheme. Beneficiaries of this scheme receive pension benefits such as GIS, GPF, leave encashment DCRG, etc. A pension is available to every regular government employee who retired after providing at least ten years of continuous service. Pro-rata pension is the sum given to beneficiaries with more than 10 but fewer than 25 years of service, whereas full superannuation pension is given to retired government employees who left their jobs after the maximum allowed duration of service. According to this plan, the director of the pension in Assam would be the pension sanctioning authority for the teaching and non-teaching personnel of government schools and PRI pension employees. For state government pensioners, the pension sanctioning authority will be the accountant general of Assam.

Also Read: One Rank One Pension (OROP)

Key Highlights of Assam Pension Scheme

| Launched By | Assam Government |

| Name of Scheme | Assam Pension Scheme 2024 |

| Objective | To provide financial assistance |

| Benefits | To guarantee the government workers’ financial security after retirement |

| Eligibility Criteria | Must be a resident of Assam |

| Beneficiaries | Government employees of Assam |

| Official Website | Assam Pension |

The objective of Assam Pension Scheme

The Assam Pension Scheme’s primary goal is to pay pensions to retired government employees. Retired government employees will learn self-reliance so they can obtain financial security through this programme. The lifestyle of retired government employees will also be improved by this programme. Through this program, the beneficiary’s bank accounts will be credited with the pension, enabling them to live respectably.

Benefits and Features of the Assam Pension Scheme

- To guarantee the financial stability of government employees after retirement, the Assam government introduced the Assam Pension Scheme.

- Beneficiaries of this scheme receive pension benefits such as GIS, GPF, leave encashment DCRG, etc.

- All regular government employees who retired after working for at least ten years continuously are entitled for pensions.

- Pro-rata pension is the sum given to beneficiaries with more than 10 but fewer than 25 years of service, whereas full superannuation pension is given to retired government employees who left their jobs after the maximum allowed duration of service.

- After completing up to 25 years of qualifying service, a pensioner is qualified to receive a superannuation pension.

- Six months after retirement, the pension documents must be presented.

- According to this plan, the directors of the pension in Assam will be the pension sanctioning authority for the teaching and non-teaching staff of government schools and PRI pension employees, and the accountant general of Assam will be the pension sanctioning authority for state government pensioners.

- Pensioners must complete the necessary form and send it, as appropriate, to the accountant general or the director of the pension.

- The authorities will approve the pension for the retiree after obtaining all the paperwork.

- As of right now, the maximum pension commutation is one-third of the base pension, excluding judicial and AIS services.

- The government employee who retires from employment, whether voluntarily or involuntarily, is obligated to appear before the medical board by the commutation of pension laws if the pensioner has asked for commutation of pension after one year from the date of retirement.

- Pension loan interest rates are 4.75% for retirees who took their retirement benefits before January 1, 2013, and 8% for those who took their retirement benefits after that date.

- The highest superannuation pension amount is $65,000, and the minimum family pension amount is $5,500.

Types of Assam Pension Scheme

Superannuation Pension

- When a government employee retires at the age of 60, they give this pension.

Pension in Retiring

- This pension is given to government employees who have retired or are about to retire before reaching the age of superannuation or to those who choose voluntary retirement after being deemed surplus. All government employees have the option to apply for voluntary retirement three months in advance after 20 years of qualified service, whichever comes first.

Ineligible pension

- If a government employee has requested retirement due to a physical or mental condition that renders them permanently unable to perform their job duties, they will receive an invalid pension. To apply for an invalid pension, the beneficiary must provide a medical report from the finished medical board.

Pension Compensation

- If a government employee is chosen for dismissal due to the elimination of a permanent position, a compensation pension is granted, unless he is appointed to another position.

Compassionate compensation

If the qualifying service at the time of discharge or retirement was less than 25 years, compensation, invalidation, and superannuation gratuities up to one full month before each completed year of service were admissible for inferior service, and pensions were available for service of 25 years and longer. When there was excellent service, a pension was given if the service lasted more than ten years and a gratuity was allowed for service that lasted less than ten years.

Exceptional Pension

If a government employee dies, gets injured, or becomes disabled while performing their duties due to an accident or another reason, their family will receive an extraordinary pension.

Pension for Family

When a government employee is widowed or widowed, a family pension is given to them; if neither of these circumstances exist, a family pension is given to the employee’s children. Other than that, the families of the deceased government employees are also given access to provisional family pensions, disability pensions, invalid pensions, etc. In the case of a son, this pension is payable to children up to the age of 18; in the case of a female, it is payable to children up to the age of 21, or the earlier of marriage. In addition, a family pension is paid to the parents of dependent siblings who marry before becoming 18 or 21, respectively, and before turning 21 for sisters. If the government employee’s son or daughter has a disorder, mental impairment, physical handicap, or both, this family pension will continue to be provided for as long as the requirements are met.

Assam Pension Scheme Guidelines

Bringing forth claims

To ensure that the Pension Payment Order is received before your retirement, claims must be made to the head office using the prescribed proforma well in advance.

PPO verification

As soon as you receive your PPO, you must check the pensionary award mentioned in the PPO to make sure it complies with current regulations. You can get in touch with the headquarters or the pension disbursing agency if any corrections are necessary.

Pension transfer amount

If a pensioner wants to receive their pension from a different paying agency, they must request a transfer of their pension account to the new paying agency through their present pension disbursing agency.

The reinstatement of a commuted pension

The commuted component of the pension can restore based on the application after 14 days from the date of receiving the commuted value of the pension.

Rent in arrears

The pension becomes time-bare and needs the approval of the appropriate authority if it is not drawn for more than a year for any reason. The PDA must receive the claim for the error and an explanation of the delay in the appropriate form.

Pensioner missing

The family must file a FIR with the police if the pensioner is discovered to be missing. If the pensioner cannot be located after a year, a certificate from the police authorities must be acquired, and the pension disbursing agency must be informed of the situation in addition to receiving an indemnity bond to approve a family pension.

Judicial attachment

The pensioner, whether due or becomes due, is free from attachment from any court until the pensioner has been paid by the pension laws. Pensioners are not permitted to sell or assign any interest in the pension that is not now payable.

Pension payment via approved Bank

Pension payments through banks are possible. Cash is not accepted as payment. To be eligible for a pension, people must open savings or current accounts in their names or joint accounts with their spouses.

Documents Required

Considering a family pension

- Request for family pension or death gratuity ( Form 21).

- Particulars of identification, height, and personal marks of the claimant in duplicate, duly attested. *Passport-size photograph of the claimant in triplicate, duly attested by the Head of Office. *Two specimen signatures, left hand (for females) or right hand (for males), with thumb impression marks.

- Evaluation of the death gratuity and the family pension ( Form 20).

- From the Department and Directorate of Estates, a No Demand/No Dues Certificate.

- SGEGIS-related annexure in duplicate (one copy pre-received).

- The date on the children’s birth certificates.

- Properly documented DCRG nomination

- Nomination for SGEGIS, properly authenticated.

- The penalty imposed for forfeiting leave by the appropriate authority (containing the amount involved and the number of days leavess at credit).

- Statement for service verification, including SGEGIS and the Service Book page.

- Pension payments and leave wage contributions are entered in the service book as being admissible.

- Statement giving specifics, the entire length of the non-qualifying service term, and a breakdown by year. Family members’ information, duly countersigned on Form 1A.

- The existence of a photocopy of the service book and pension file.

If a government employee retires

- Information about the departing government employee (Form 1).

- Request for a Commutation (Form A).

- Family information, properly countersigned (Form 1A).

- Evaluation of the pension and gratuity (Form 2)

- Single or joint passport-size photo (with a spouse), properly attested by the Head of Office, in three copies.

- Two sample signatures or a left/right-hand thumb impression mark in duplicate, officially attested by a government employee listed in the gazette.

- Two slips with the information on height and two or more personally identifiable marks, fully attested by a government employee listed in the gazette.

- retirement directive.

- From the Department and Directorate of Estates, a No Demand/No Dues Certificate.

- a certificate of discipline or vigilance clearance.

- *SGEGIS-related annexure (one copy pre-received) in duplicate. *DCRG nomination, with proper authentication. *SGEGIS nomination, with proper authentication.

- Calculation sheet for pensions.

- sanction from the appropriate authority for using vacation time (containing the amount involved and the number of days leave at credit).

- Statement for service verification, including SGEGIS and the Service Book page.

- Entry in the service book for the payment of the leave salary contribution and the pension for qualified retirees.

- *In the case of Group “A” pensioners, a declaration of no employment following retirement if the pension is received from PAO.

- Statement giving specifics, the entire length of the non-qualifying service term, and a breakdown by year.

- *Nomination for the payment of pension arrears.

Eligibility Criteria

- The applicant must reside in Assam permanently.

- The candidate must work for the government.

- The applicant must have worked for the government for at least 10 years and at most 25 years.

Also Read: National Pension Scheme

Application Process for Assam Pension Scheme

- Visit the pension disbursing agency first.

- Take the pension application there

- Complete this form by providing all the necessary information.

- Now, include all necessary paperwork.

- Then deliver this form to the pension disbursing organization.

- You can apply for the Assam Pension Scheme by following this process.

Assam Pension Scheme: Learn More About the Transactions

- Initially, visit the pension and public grievances department’s official website.

- Before you will be the home page.

- You need to click on the information in the services link on the homepage.

- You must now click on the transaction details.

- Before you will be a new page.

- You can find information about the business that done on this page.

Discover More About The Services Offered

- Visit the pension and public grievance Official website.

- Before you will be the home page.

- You must now select the information and services link.

- Following that, you must click on the service details presented.

- Before you will be a new page.

- You can find information about the offered services on this page.

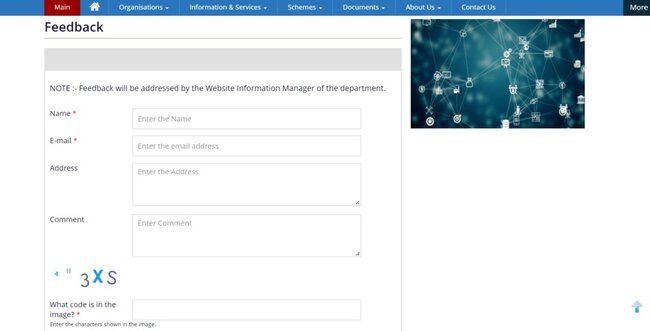

How to File a Complaint

- Initially, visit the pension and public grievances department’s official website.

- Before you will be the home page.

- You must now select “Locate your Complaint“

- Before you will be a new page.

- On this page, you must select “complaint.”

- Following that, you must select “Locate Pension Grievance.”

- You must now select “file a complaint.”

- The type of pensioner must then choose.

- You must now select “Continue”

- You’ll get to a different page.

- You must provide certain information on this page, including the ministry/department name, office/organization details, grievance category, PO number, gender, name, age, mobile number, email address, address, state, pin code, kind of pension, bank name, bank account number, IFSC code, etc.

- After that, you must select “submit.”

- This process will allow you to lodge your ingredients.

Check the Status of Your Complaint

- Visit the official website of the centralized pension grievance redress and monitoring system to view the status of your complaint regarding the Assam Pension Scheme.

- Before you will be the homepage.

- You must select a view from the homepage’s menu.

- Before you will be a new page.

- You must input your registration/appeal number, cellphone number, and security code on this page.

- After that, you must select “submit.”

- This process will allow you to see the complaint states.

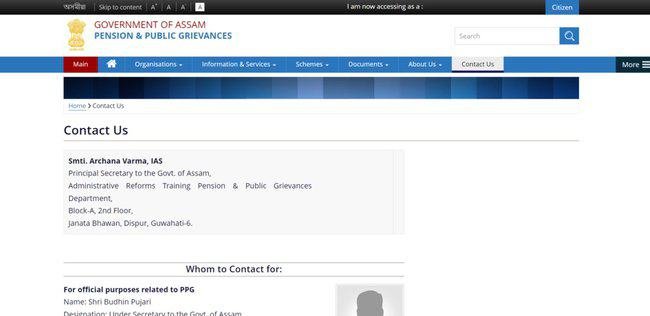

View Contact Information for Assam Pension Scheme

- Visit the pension and public grievance official website.

- Before you will be the home page.

- You must click on the CONTACT US option..

- Before you will be a new page.

- You can utilise your contact information on this page.